Turn on any financial news network like CNBC these days and you’re likely to hear some discussion about inflation and concerns about recession. Even if your students aren’t listening to those stories, they might be hearing about them from their parents or perhaps in your classroom as part of a current events discussion. Financial news was always a topic in my classroom when I taught a current events course.

If you find yourself talking about inflation, recession, and related topics in your classroom, here are some videos that could help your students gain a better understanding of those topics.

Inflation Explained in One Minute provides a very basic explanation of the concept of inflation. It could be fine as a conversation starter or introduction to a lesson. However, if viewed on its own without additional information it might give students the impression that inflation is solely caused by changes in money supply.

How Inflation Works is an excellent twelve minute video lesson produced by CNBC International. The video does a great job of explaining demand-pull inflation and cost-push inflation. Going beyond the the basics the video also provides an excellent comparison of the economic theories of Milton and Keynes. Students will also learn how consumer price index is calculated and how it is indicative of inflation. Finally, the video concludes with historical examples of inflation around the world and the causes of those hyperinflationary episodes. I should note that the video will lend itself to introducing other concepts to your students including the importance of the federal reserve’s interest rate.

If you or your students would prefer an animated lesson about inflation, The School of Life offers this solid explanation of cost-push and demand-pull inflation.

Related TED-Ed Lessons

TED-Ed has four lessons that could fit in well with a larger discussion and lessons related to inflation.

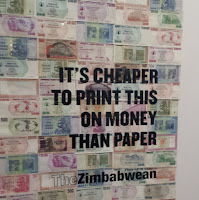

Why Can’t Governments Print an Unlimited Amount of Money? explains the concept of quantitative easing in the context of the last two years.

What Give a Dollar Bill Its Value? explains the role of the Federal Reserve in trying to control inflation and deflation.

What Causes an Economic Recession? uses the context of the Bronze Age to introduce the factors that can lead to economic recessions today. Those include inflation, borrowing habits, saving habits, spending habits, and government decisions.

What Causes Economic Bubbles? uses the context of the tulip industry of the 1600’s to explain what causes an economic bubble and what happens when it bursts.

Inflation Calculators

Inflation calculators are useful in helping students see the effects of inflation over time. The U.S. Bureau of Labor Statistics offers a free inflation calculator that lets you go back as far as 1913 to view changes in prices and buying power over time. It’s how I figured out that the first car I ever bought back in the fall of 1996 for $1500 would cost almost $2700 today (and still be a hunk of junk).

Finally, on the topic of money, next week I’m hosting a Practical Ed Tech webinar about how to create and sell your own digital products. Join me!