The EV space was swathed in a sea of red in the week ending March 4, although market leader Tesla, Inc. (NASDAQ: TSLA) and a handful of stocks managed to buck the downtrend. The negative sentiment can be traced back to company-specific catalysts, which pressured stocks.

Here are the key events that happened in the EV space during the week:

Telsa: Giga Berlin Update, UAW Warning, Cybertuck Prototype And More: Tesla, as usual, was brimming with activity during the week. The most promising news was the company securing approval from the local Brandenburg government for commencing operations at its Giga Berlin. All the same, the company has to navigate through some small hurdles, including a legal challenge by a local environmental group, before beginning to kick-start production of Model Y vehicles at the plant.

Tesla’s effervescent CEO Elon Musk dared the powerful United Auto Workers union to hold a vote to bring into the union’s net the non-unionized employees at its Fremont, California plant. Musk rationalized that the Bay Area has negative unemployment and therefore if not compensated well, employees will gravitate to more promising opportunities.

Tesla’s battery supplier Panasonic Corporation (OTC: PCRFY) is eyeing to build a big plant in the U.S. to supply the EV maker with lithium-ion batteries, Japanese media outlet NHK reported.

Musk may have signaled on the fourth-quarter earnings call that the much-awaited Cybertruck is likely to be delayed until 2023 due to supply constraints. During the week, a new prototype of Tesla’s Cybertruck with a bed cover was reportedly spotted at the Fremont plant, creating a stir among those waiting for one of Tesla’s much-anticipated releases.

Ford Announces Bold Moves: Ford Motor Company (NYSE: F), which is among the most proactive of legacy automakers, is raising the stakes. In a video released by the company this week, Ford CEO Jim Farle made a slew of announcements that will go toward unlocking the potential of its EV business.

The company will be splitting its ICE and EV businesses into two units, naming the former as Ford Blue and the latter as Ford Model e. The separation will help the company to achieve “startup speed” in pursuing its EV vision.

Meanwhile, monthly sales released by Ford showed that its Mustang Mach-E sales fell 46.5% year-over-year to 2,001 units, apparently due to chip shortages.

Related Link: Elon Musk Takes Chinese Ambassador To US On Drive In Model S Plaid

China EV Sales Disappoint: U.S.-listed Chinese EV trio Nio, Inc. (NYSE: NIO), XPeng, Inc. (NYSE: XPEV) and Li Auto, Inc. (NASDAQ: LI) all reported month-over-month declines in sales in February. The shortfall was blamed on the slower period coinciding with the Chinese New Year holiday that fell between Jan. 31 and Feb. 6.

Warren Buffet-backed BYD Company Limited (PNK: BYDDF), meanwhile, continued its outperforming streak, raking in sales that exceeded the combined volume of Nio, XPeng and Li Auto.

Nio Succeeds In Getting Nod For Hong Kong Listing: Nearly a year after an initial report on a potential listing in Hong Kong, Nio confirmed it has received in-principle approval for pursuing a secondary listing on the Hong Kong stock exchange. In an unusual move, the company opted to list by way of introduction, without issuing fresh shares to raise proceeds.

Lucid Sinks On Guidance Cut: Lucid Group, Inc. (NASDAQ: LCID) reported its financial results for the fourth quarter during the week. The luxury sedan maker missed expectations for the quarter and also announced a deep cut to its delivery guidance for 2022.

Rivian Hikes Prices, Rolls Back Soon After: Rivian Automotive, Inc. (NASDAQ: RIVN) made a gaffe this week by announcing a 20% price increase for its R1T pickup truck and R1S SUV. Following a backlash from customers, the company’s CEO RJ Scaringe said in a letter, the company will reinstate original prices for preorders as of March 1. The CEO said the price hike was the “most painful mistake” the company has made thus far.

Fisker Ocean SUV Makes European Debut: Fisker, Inc. (NYSE: FSR) debuted its Fisker Ocean SUV in Europe by displaying the vehicle at the Mobile World Congress in Barcelona.

GM Sells Stake In Lordstown: Embattled EV startup Lordstown Motors Corp. (NASDAQ: RIDE) came under strong selling pressure after General Motors Corporation (NYSE: GM) sold the 7.5 million shares it owned in the former. The disposal was made in the fourth quarter following an undisclosed lock-up period.

Sony, Honda In EV Collaboration: Japanese electronics giant Sony Group Corporation (NYSE: SONY) and Honda Motor Co., Ltd. (NYSE: HMC) announced plans to join forces to build EVs. The two companies have signed a memorandum of understanding, to establish a joint venture for the development and sales of “high value-added” battery EVs and commercialize them in conjunction with providing mobility services.

The first EVs from the venture will roll out in 2025.

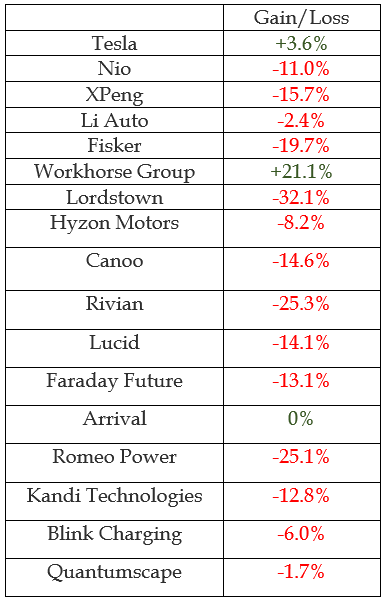

EV Stock Performances for The Week:

Related Link: Why Ford Analysts See Reorganization As ‘Dawn Of New Era,’ Expect Other Automakers To Follow Suit

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.