I frequently write that the world economy is, in physics terms, a dissipative structure that is powered by energy. It can grow for a time, but eventually it reaches limits of many kinds. Ultimately, it can be expected to stop growing and collapse.

It seems to me that the world economy is showing signs that it has reached a turning point. Economic growth stopped in 2020 and is having trouble restarting in 2021. Fossil fuel energy of all types (oil, coal and natural gas) is in short supply, relative to the world’s huge population. Ultimately, this inadequate energy supply can be expected to pull the world economy toward collapse.

The world economy doesn’t behave the way most people would expect. Standard modeling approaches miss the point that economies require adequate supplies of energy products of the right kinds, provided at the right times of day and year, if they are to keep from collapsing. Shortages are not necessarily marked by high prices; prices that are too low for producers will bring down the energy supply quickly. A collapse may occur due to inadequate demand; in fact, such a scenario is described in Revelation 18.

As strange as it may seem, we may be approaching what some of us would think of as end times, if our economy collapses for lack of cheap-to-produce energy supplies. In this post, I will try to explain what is happening.

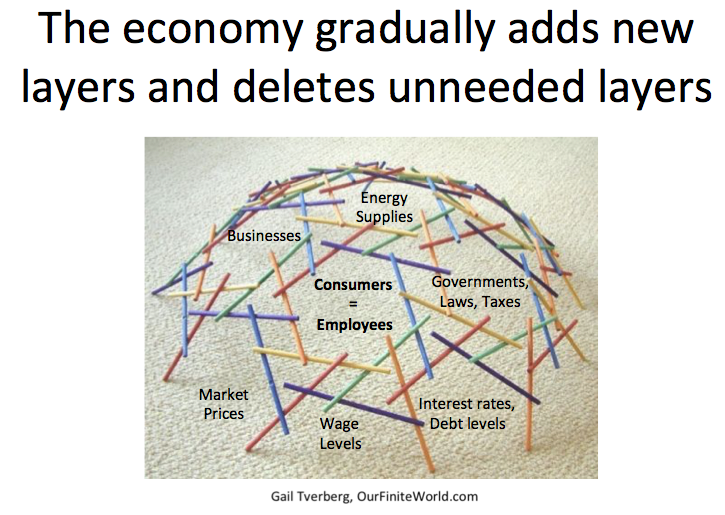

[1] In some ways, the self-organizing economy is like a child’s building toy that, with the use of human energy, can be built up to higher and higher levels.

The economy is gradually built up by the addition of new customers, new businesses and new products. Governments play a role as well, adding new infrastructure, laws and taxes. Adequate wages for employees are important because, to a significant extent, employees are also consumers of goods and services made by the economy.

Adequate energy supplies of the right types are terribly important because every process used by the economy requires energy, even if the only energy used is electricity to light a light bulb or operate a computer. Heating and cooling require energy, as does transportation.

Human energy is an important part of the economy, as well. Humans eat food to provide them with energy. An individual human’s own energy output is relatively tiny; it is about equal to the output of a 100-watt light bulb. With the use of supplemental energy of various kinds, humans can do many tasks that would not be possible otherwise, such as cooking food, creating metals from ores, heating homes, and building cars and trucks.

The economy cannot “go backwards” because, if a product is no longer needed, it will no longer be produced. The economy represented by Figure 1 is in some sense hollow inside. For example, once people started using automobiles, buggy whips were no longer made. If cities went back to using horses as their main means of transport, we would need manure removal services. These, too, would be missing.

[2] Another way of thinking about the world economy is that it is somewhat like a rocket that needs fuel. It also has waste outputs. Both of these limit the growth of the world economy.

The economy uses a wide array of inputs. At the same time, it produces a whole host of undesirable outputs. Inputs need to be inexpensive to produce, or citizens will not be able to afford the goods and services made by the system. The waste outputs cannot become too significant, or they can lead the economy to fail. In fact, with the world’s growing population, we seem to be reaching many limits with respect to both inputs and undesirable outputs, simultaneously.

[3] Strangely enough, the major energy limit that the world economy is hitting seems to be “energy prices that do not rise high enough for producers.”

This energy limit is exactly the opposite of what most people are looking for. They assume that “demand” will always rise. In fact, the cost of production of energy products keeps rising because the easy to produce energy products are produced first. It is the market prices that energy products can be sold for that do not rise adequately.

When we trace the problem back, we discover that the problem with prices arises from the equivalence between producers of goods and services and consumers of goods and services indicated on Figure 1. In order to have enough “demand” to keep energy prices high enough for providers, it turns out that even the very low wage people in the world economy need to be able to afford necessities such as food, water, clothing, basic housing and transportation. In fact, if the cost of extracting fossil fuels rises too quickly because of depletion, or if the cost of getting renewable electricity into a form in which it is useful for society rises too much, there may be a situation when even a price based on full demand from all consumers is too low for energy producers.

Let’s define “return on human labor” as what a person without advanced training can earn by selling his physical labor as unskilled labor. Rather than dollar or euro terms, wages need to be thought of in terms of the physical goods and services that these wages can purchase. If supplemental energy per capita is rising rapidly, the return on human labor tends to rise. This happens because with higher energy consumption, humans can have more tools and technology requiring energy at their command. For example, the period between 1950 and 1970 was a time when energy consumption was rising rapidly. It was also a time of rising standards of living, even for workers without advanced training.

The world economy can be expected to run into a major problem once supplemental energy consumption per capita starts falling because then human labor is necessarily less leveraged by fewer machines, such as trucks and airplanes. In total, fewer goods and services can be produced.

If energy supply is inadequate, businesses often find it advantageous to substitute computers or other machines for some work previously done by low paid workers. While these machines use a little energy in their operation, they do not need food, housing or transportation the way human workers do. With fewer actual workers, demand for finished goods and services tends to fall, pushing commodity prices, including those for fossil fuels, down. This further adds to the low-price problem.

It is the lack of jobs that pay well that tends to hold down commodity prices below the prices producers require. Ultimately, it is the lack of sufficient jobs that pay well that tends to bring the whole economy down. Most researchers have missed this important point.

[4] In the period leading up to collapse, wages fail to rise with the cost of required services. This leads to increasingly unhappy workers. Healthcare costs and college costs are especially problematic, because their costs have been rising faster than costs in general.

Figure 4. Illustrates the issue that seems to be occurring:

When energy consumption per capita is growing rapidly, the economy adds items that were not previously considered necessary. Instead of a basic education for all being sufficient, advanced education (often paid for by the student) becomes necessary for many jobs. Healthcare costs keep rising rapidly, making it more difficult to make wages cover all necessary expenses (Figure 4).

We can see additional evidence that workers have been tending to get poorer in recent years by looking at the trend in the number of light vehicles purchased. With rising population, a person would expect the number of automobiles sold to increase, year after year, if citizens found their incomes as adequate as in the past. Instead, we see a pattern of falling automobile sales, practically everywhere, starting well before 2020. For example, peak light vehicle sales in China occurred in 2017.

[5] An increase in debt can temporarily be used to hide both inadequate inexpensive-to-produce energy supply and inadequate wages of workers, but we seem to be reaching limits using this approach to hide energy problems.

The last time the world had relatively stable low oil prices was in the years prior to 1973. As noted previously, low energy prices tend to make finished goods, such as homes and cars, inexpensive to buy and operate. Thus, they tend to be affordable.

The big issue if oil and other prices rise very high is that the selling prices of goods and services tend to rise too high to be affordable to consumers. The workaround that was developed to fix this unaffordability problem was to change the economy to use more debt. To be affordable, interest rates had to fall lower and lower. Peak interest rates occurred in 1981; they have been trending downward since then.

If debt at ever-lower interest rates is available, assets such as homes, farmland, factories and shares of stock become more affordable, allowing prices of these assets to rise. Owners of these assets feel wealthier. In fact, they may borrow more money against the inflated price of these assets and use this money to buy more goods and services made with commodities, thus helping to raise commodity prices. The lower interest rates make the purchase of automobiles more affordable as well, helping to raise the price of commodities used to make and operate automobiles.

There is a limit on how low these interest rates can go, however, especially if inflation is a problem. Current interest rates seem to be down near where they were during the Great Depression of the 1930s. This suggests that the economy is truly doing very poorly.

Today, Brent oil prices are about $69 per barrel. This price is not high enough for producers to want to prepare more fields for drilling. As far as I can see, the price needs to be up in the range of $120 per barrel, and stay there for many years, for oil producers to consider putting major effort into developing more fields. Natural gas and coal have similar low-price problems.

While governments cannot seem to be able to fix the low-price problem for fossil fuels, they can find ways to pay their citizens money for doing nothing, or next to nothing. These payments will add to a government’s debt, but they don’t really produce more goods and services. What these payments tend to produce is inflation in the prices of goods and services that are available.

Over time, we can expect the lack of growth in energy supply to lead to an increasing number of broken supply lines. Without long-term high-price guarantees, producers will not be willing to increase production. Without adequate fuel supply, an increasing number of products will disappear from the shelves of stores. A smaller number of people will have jobs, especially jobs that pay well. The economy can be expected to head in the direction of collapse.

We can think of debt as a promise of future goods and services, made with future energy production. If energy supplies are rising rapidly and can be expected to continue to rise rapidly in the future, this promise can be expected to hold. Of course, if energy supplies start falling, all bets are off. Supply lines are likely to break. We consider money and other securities issued by governments to be a “store of value,” but, if there is little to buy (for example, all international flights are cancelled and automobiles of the desired type are permanently out of stock), its ability to act as a store of value will start to disappear. If the economy collapses completely, neither stocks nor bonds will have value.

[6] Nothing happens for a single reason in a self-organizing economy. Lack of energy affects every part of the economy, from jobs to finished output, almost simultaneously.

In a self-organizing economy, everything is interconnected. Inadequate energy per capita leads to low selling prices for commodities of all kinds. Inadequate energy per capita also leads to low wages for workers, low benefits provided by governments, and uprisings to protest these low wages and benefits. These uprisings began in 2019 or even earlier.

The unhappiness of workers leads to the election of increasingly radical politicians, in the hope that something can be done to fix the problems. There are basically not enough goods and services to go around, but no one wants to admit that this could be a problem.

[7] Citizens cannot imagine a declining and eventually collapsing economy. Businesses, governments and individual citizens all demand “happily ever after futures.”

If there is a history of growth, nearly everyone is happier if forecasts pretend that economic growth can continue forever. Newspapers want such stories, because this is what their advertisers, such as automakers, want. Automobiles need to be usable for a long period in the future. Universities want favorable forecasts because they want their students to believe that their degrees will have great future value. Politicians want a story of growth forever, because this is what voters want and expect. They have come to believe that governments can save them from all problems; there is no longer any need for religion.

As energy supplies get scarce, the rich tend to become richer and the poor tend to become poorer. François Roddier explains that this is because of the physics of the situation. Wealthy individuals and corporations discover that they have a rapidly growing ability to influence the narrative provided by Mainstream Media. If influential citizens and groups want citizens to hear a “happily ever after ending” to our current problems, they can make certain that this is the predominant narrative of Mainstream Media. It is only people who are willing to hear sources outside of the mainstream who can learn what is really happening.

The fact that the world economy would run into energy limits about now has been known for a very long time. For example, US Navy Rear Admiral Hyman Rickover talks about the close connection between energy and the economy in this 1957 speech. He points out that the world is likely to run short of fossil fuel by 2050. Later modeling documented in the 1972 book The Limits to Growth indicated that the world economy was likely to collapse in a similar timeframe. The modeling done in that analysis considered rising population relative to total resources, without looking at energy resources separately.

[8] It is easy to create models that predict growth will continue forever, even if the physics of the situation says this is not possible.

Economists provide their work to politicians. They certainly cannot provide forecasts of a coming calamity such as economic collapse. They also are unaware of the physics of the situation, even though many researchers have been writing about the issue from a physics point of view since at least the mid-1980s.

Economists have chosen instead to make models that assume no limits are ahead. They seem to assume that all problems will be fixed by innovation, substitution and the pricing mechanism. They produce forecasts suggesting that the economy can grow endlessly in the future. Based on these forecasts, they provide input to models that reach the conclusion that amazingly large amounts of fossil fuels will be extracted in the future. Based on these nonsensical models, our problem is not the near-term limits that we are reaching; instead, our chief problem is climate change. Its impacts occur mostly in the future.

A corollary to this belief system is that it is we humans who are in charge and not the laws of physics. We can expect governments to protect us. We don’t need any outside help from a literal Higher Power who created the laws of physics. We need to listen to what the authorities on earth tell us. In fact, in troubled times, governments need more authority over their citizens. The many concerns regarding COVID-19 make it easy for governments to increase their control over citizens. We are told that it is only by following the mandates of governments that we will get through this strange time.

With nearly everyone on board with the idea that somehow the story of near-term collapse must be avoided at all costs, every part of the economy bases its actions on the narrative that the world economy is voluntarily moving away from fossil fuels. In this narrative, renewables will save us; electric vehicles are the way of the future; the world economy can continue to grow, but in a new way.

In fact, we are colliding with resource limits, right now. This seems to be what produced the bizarre situation experienced in 2020.

[9] As 2020 began, many sectors of the world economy were squeezed simultaneously. With limited energy resources, large parts of the economy needed to be cut back. The self-organizing economy acted in a very strange way. Shutdowns supposedly aimed at stopping COVID-19 from spreading acted very much like energy rationing, without mentioning the world’s energy problem.

Several years before 2020, it should have been clear that the world economy was doing very poorly based on the continued need for very low interest rates (Figure 7) and Quantitative Easing. China, in particular, was doing poorly, as indicated by its low sales of automobiles (Figure 5). Of course, China doesn’t broadcast its problems to the rest of the world, so few people were aware of this issue.

China had been able to boost the world’s per capita supply of inexpensive-to-produce energy by ramping up its coal production after it joined the World Trade Organization in 2001. (Note the world ramp-up in coal, starting after 2001, on Figure 9.) Unfortunately, because of depletion, China’s coal production since 2013 has been close to flat. Furthermore, China had had a big recycling business, but discontinued it effective January 1, 2018. Discontinuation of this program was necessary because oil prices had fallen in 2014 and had never recovered to their former level. With low oil prices, most recycling in China made no sense economically. The loss of jobs from recycling and cutbacks in coal operations no doubt contributed to the declining sale of vehicles in China.

In the years before 2020, another big issue was that the wages of many workers were not keeping up with the rising cost of living. Figure 4 illustrates this issue for the US. The problem was especially acute for lower wage workers. During this period, the prices of many commodities were too low for producers. This led to layoffs and low wages for workers.

In early 2020, the world became aware of a new coronavirus that had been identified in China. The response to this new illness was very strange, compared to how previous pandemics had been handled. The response looked a great deal like intentionally scaring people (especially older people) into staying at home. If this were done, much less oil could be used. Natural gas and coal consumption could be reduced, as well.

This story is perhaps not so strange if we look at it in context. On January 8, 2020, I wrote that we should be expecting recession and low oil prices in 2020. I included this oil price chart.

On January 29, I wrote, It is easy to overreact to a coronavirus. In this article, I pointed out that the economy already seemed to be headed in the direction of recession. Shutdowns would only make the problem worse.

Politicians choosing to shut down their economies in early 2020 were likely not aware that the real underlying problem within their economy was inadequate availability of inexpensive-to-produce energy. They were aware that China had decided to shut down part of its economy, so perhaps there might be some usefulness to such an action. Local leaders outside of China knew that their own factories were underutilized. If their own factories could be shut down temporarily, perhaps they could operate at closer to capacity, once they reopened.

Furthermore, a shutdown would give an excuse to keep workers protesting low wages inside. After the shutdown, there would be an excuse to raise the debt level, perhaps keeping the financial part of the economy going for a while longer. So, a shutdown would have many benefits, apart from any potential benefit from (sort of) containing the virus.

It became apparent as time went on that the vaccine story for COVID-19 was playing multiple roles, as well. The healthcare industry was becoming very large in the US. In fact, the size of the healthcare industry was beginning to interfere with the economy as a whole (Figure 4). Furthermore, manufacturers of medicines and vaccines were having problems with diminishing returns because the big, important drug finds had been discovered years ago. It was becoming difficult to profitably fund all of the research needed for new drugs.

Behind the scenes, the vaccine industry had been working for years on creating new viruses and preparing vaccines for these same viruses. The theory was that the same approaches that delivered vaccines might be helpful in treating diseases of various kinds. Vaccines might also be helpful in responding to bioweapon attacks. If drug manufacturers could market a blockbuster vaccine, the manufacturers, as well as the individuals holding the vaccine patents, could become rich.

The US was not alone in the research with respect to viruses and vaccines for these viruses. Many major countries, including Canada, France, Italy, Australia and China had funded this research, partly through their budgets for health research and partly through military budgets. There was virtually no chance that anyone would figure out the source of any problematic virus because so many major countries had had a part in funding this research. If citizens could be convinced that the virus was extremely dangerous and mandate the use of vaccines, the vaccine industry could greatly profit from vaccine sales. The vaccine could be created and marketed quickly because all of the research (but not enough testing) had been performed earlier.

A great deal of planning had been done before the pandemic appeared, based to a significant extent upon what outcome vaccine makers would prefer. Johns Hopkins University completed a SPARS Pandemic Scenario in October 2017, rehearsing responses to a pandemic. A training exercise called Event 201 was held on October 18, 2019, for the purpose of training high level government officials and news writers what their responses should be.

The sponsors of Event 201 were “The Johns Hopkins Center for Health Security in partnership with the World Economic Forum and the Bill and Melinda Gates Foundation.” The latter two organizations are representatives of the very wealthy individuals and very large corporations. The primary interest of these organizations is enriching those who are already wealthy. The World Economic Forum is known for proclaiming, “You’ll own nothing and you’ll be happy.”

As time went on, it became very clear that the true nature of the COVID-19 epidemic was being hidden from citizens. It was, and is, not a terribly dangerous illness if it is treated properly with any number of inexpensive medications including aspirin, ivermectin, antihistamine and steroids. In fact, the severity of the disease could also be lessened by taking vitamin D in advance. There really was not a great deal of point to the vaccines, except to enrich the vaccine manufacturers and those who would benefit from the sale of the vaccines, including Anthony Fauci and the Bill and Melinda Gates Foundation.

It also became clear that the vaccines don’t really do what a person might expect a vaccine to do. They do tend to stop severe illness, but taking vitamin D in advance would provide pretty much the same benefit. They don’t stop COVID-19 from circulating because vaccinated people can still catch COVID-19. The vaccines seem to have any number of side effects, including raising the risk of heart attacks.

The historical period most similar to the current period, in terms of shortage of energy supply, is that between World War I and World War II. At that time, the Jews were persecuted. Now, there is an attempt to divide the world into Vaccinated and Unvaccinated, with the Unvaccinated persecuted. When the economy cannot produce enough goods and services for all members of the economy, the economy seems to divide into almost warring parts.

We are basically trying to deal with an energy scenario that looks a lot like Figure 8, and the self-organizing economy comes up with very strange solutions. If people can convince themselves that it is OK to ostracize the unvaccinated, then maybe the move down the collapse will go more smoothly. For example, the military can be cut back in size by dismissing the unvaccinated, without admitting that with current resources, there is a need to reduce the size of the military.

Europe is the part of the world where the push for vaccinations is now highest. It is also in terrible shape with respect to energy supply. By ostracizing the unvaccinated, European countries can attempt to cut back their economies to the size that their energy supply will support, without admitting the real problem.

[10] The world economy is increasingly acting like economies that have collapsed in the past. In fact, there seems to be a connection with some of the strange statements from the book of Revelation.

We are living in a world now in which even if there are temporary price spikes, there is little chance that fossil fuel providers will ramp up their production. In order to ramp up supplies, they would need to start several years in advance, preparing new fields. Oil, coal and gas prices have stayed so low, for so long, that there is no belief that prices can rise to a high enough level and stay there, as the fuels are extracted. Thus, the fossil fuel will stay in the ground.

At the same time, it is becoming increasingly clear that renewables cannot be depended upon. In fact, low generation of electricity by wind turbines is part of the reason Europe is having to import the large quantity of natural gas and coal supplies it now requires. There is concern that rolling blackouts may be necessary during the winter in Europe, if not this year, sometime in the next few years.

It is becoming increasingly clear that the future energy scenario will look something like Figure 8, causing world population to fall dramatically within the next thirty years. This is the kind of situation most of us would associate with collapse. I think of it as being equivalent to end times, since our modern civilization will be disappearing. It is possible that there will be a remnant of people left, but they will be living a much simpler life, without fossil fuels or modern renewables.

There are several parts to what is happening that remind me of Old Testament writings in general, and of the book of Revelation (from the New Testament), in particular.

First, the willingness of the ultra-rich to look out for themselves and keep what look like perfectly good, cheap cures for COVID-19 from the world population seems to be precisely the kind of despicable behavior that Old Testament prophets despised. For example, in Amos 5:21-24, Amos tells the Jews that God despises their prior behavior. In verse 24 (NIV), he says, “But let justice roll on like a river, righteousness like a never-failing stream!”

As I noted in the introduction, Revelation 18 talks about lack of demand being an issue in the collapse of Babylon, and presumably in any future collapse that occurs. Revelation 18:11-13 reads:

11 The merchants of the earth will weep and mourn over her because no one buys their cargoes anymore— 12 cargoes of gold, silver, precious stones and pearls; fine linen, purple, silk and scarlet cloth; every sort of citron wood, and articles of every kind made of ivory, costly wood, bronze, iron and marble;13 cargoes of cinnamon and spice, of incense, myrrh and frankincense, of wine and olive oil, of fine flour and wheat; cattle and sheep; horses and carriages; and human beings sold as slaves.

The need for vaccine passports in some countries reminds a person of Revelation 13:17, “they could not buy or sell unless they had the mark, which is the name of the beast or the number of its name.” In fact, people in Sweden are getting microchip implants after its latest COVID passport mandate.

Some people believe that Revelation 12 describes the Antichrist; that is, the polar opposite of Christ. Before the world comes to an end, Revelation 12 seems to predict a great fight against this Antichrist, which Christ wins. I could imagine Anthony Fauci being the Antichrist.

We are not used to living in a world where very little that is published by the Mainstream Media makes sense. But when we live in a time where no one wants to hear what is true, the system changes in a bizarre way, so that a great deal that is published is false.

It is disturbing to think that we may be living near the end of the world economy, but there is an upside to this situation. We have had the opportunity to live at a time with more conveniences than any other civilization. We can appreciate the many conveniences we have.

We also have the opportunity to decide how we want to live the rest of our lives. We have been led for many years down the path of believing that economic growth will last forever; all we need to do is have faith in the government and our educational institutions. If we figure out that this really isn’t the path to follow, we can change course now. If we want to choose a more spiritual approach, this is a choice we can still make.