High-profile entrepreneurs like Elon Musk, venture capitalists like Peter Thiel and Keith Rabois, and big companies like Oracle and HP Enterprise are all leaving California. During COVID-19, Zoom-enabled tech workers have discovered the benefits of remote work from cheaper, less congested communities elsewhere. Is this the end of Silicon Valley as we know it? Perhaps. But other challenges to Silicon Valley’s preeminence are more fundamental than the tech diaspora.

Understanding four trends that may shape the future of Silicon Valley is also a road map to some of the biggest technology-enabled opportunities of the next decades:

- Consumer internet entrepreneurs lack many of the skills needed for the life sciences revolution.

- Internet regulation is upon us.

- Climate response is capital intensive, and inherently local.

- The end of the betting economy.

Inventing the future

“The best way to predict the future is to invent it,” Alan Kay once said. 2020 proved him both right and wrong. The coronavirus pandemic, or something worse, had long been predicted, but it still caught the world unprepared, a better future not yet invented. Climate change too has been on the radar, not just for decades but for over a century, since Arrhenius’s 1896 paper on the greenhouse effect. And it has long been known that inequality and caste are corrosive to social stability and predict the fate of nations. Yet again and again the crisis finds us unprepared when it comes.

In each case, though, the long-predicted future is still not foreordained. It is up to us whether we are steamrollered by events beyond our control or whether we have the collective power to invent a better future. Awakening may have come later than we might have wished, but crises like the pandemic and climate change can still be massive drivers of innovation. If entrepreneurs, investors, and governments step up to solve the hard problems that we face today, the future remains bright. But one thing is certain: the inventions we most urgently need will take us in a very different direction than the consumer internet and social media revolution that is coming to an unsightly end.

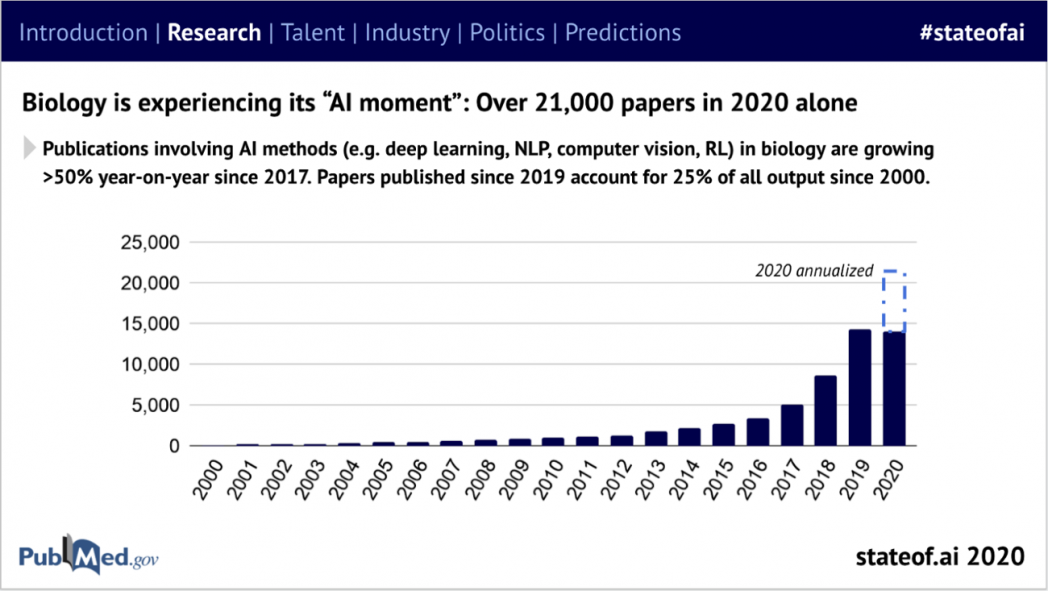

The coronavirus is a case in point. The explosion of biomedical invention that it has accelerated may well have impacts that extend well beyond the pandemic itself. mRNA vaccines have given us a promising path to COVID immunity, developed in record time. Moderna’s vaccine was created within only two days after Chinese scientist Yong-Zhen Zhang released the genetic sequence of the virus! And mRNA vaccines are also easily tweaked, raising the possibility of even quicker response to mutations, and even the creation of a framework for rapid development of many more vaccines. We are starting to see the payoff of radically new approaches to biomedical innovation, and in particular, the way that machine learning is turbocharging research. During 2020, more than 21,000 biomedical research papers made reference to AI and machine learning.

The recent announcement by DeepMind that its AlphaFold technology is able to predict protein structure with accuracy comparable to slow and costly experimental methods is a harbinger of breakthroughs to come. As geneticist Tim Hubbard wrote, “The genomes we believed were blueprints for life were effectively encrypted—this will unlock them and transform biological and biomedical research.”

Prediction: The nexus of machine learning and medicine, biology, and materials science will be to the coming decades what Silicon Valley has been to the late 20th and early 21st century.

Why might this mark the end of Silicon Valley as we know it? First, the required skills are different. Yes, machine learning, statistical analysis, and programming are all needed, but so is deep knowledge of relevant science. The hubs where that knowledge can be found are not the special province of Silicon Valley, suggesting that other regions may take the lead. Second, many of the markets where fortunes will be made are regulated; navigating regulated markets also takes skills that are conspicuously missing in Silicon Valley. Finally, as Theranos demonstrated so vividly, it is harder to sustain a hype balloon in a scientific enterprise than in many of the markets where Silicon Valley has prospered. Many Silicon Valley investors have been lucky rather than smart. They may not do so well in a world where capital must be directed toward solving hard problems rather than toward winning a popularity contest.

Mastering “the demons of our own design”

The opportunity of machine learning in scientific R&D is profound. But machine learning also challenges our current approach to science, which relies on human theorizing and experiments. A machine learning model may be able to make successful predictions but not to explain them. When Arthur C. Clarke wrote “Any sufficiently advanced technology is indistinguishable from magic,” was he imagining a future in which our own science would leave our understanding behind? As Judea Pearl has noted, excessive identification of correlations (i.e, “curve fitting”) makes the definition of authentic causal relationships more challenging. And “real science” needs causal relationships.

I suspect that we will come to terms with machine learning-enabled science, just as we’ve come to terms with instruments that let us see far beyond the capabilities of the naked eye. But without a better understanding of our machine helpers, we may set them down paths that take us to the edge of a cliff, much as we’ve done with social media and our fractured information landscape.

That fractured landscape is not what was predicted—internet pioneers expected freedom and the wisdom of crowds, not that we would all be under the thumb of giant corporations profiting from a market in disinformation. What we invented was not what we hoped for. The internet became the stuff of our nightmares rather than of our dreams. We can still recover, but at least so far, Silicon Valley appears to be part of the problem more than it is part of the solution.

Can technology platforms rein in the demons of our own design (to use Richard Bookstaber’s memorable phrase)? That too will be one of the challenges that shape the coming decades.

Government regulators in Europe and the US have set their sights on Facebook, Google, Amazon, and Apple, but the regulatory responses will be insufficient if they are based on old theories, old understandings that the platforms have already outstripped. The US theory of antitrust has largely been based on the question of consumer harm, which is difficult to prove in marketplaces where services are provided to consumers at zero cost and where the marginal cost of experimenting on those consumers is also close to zero. The emerging European regulatory effort is properly focused on the role of dominant tech firms as “gatekeepers.” It aims to systematically limit their ability to shape the market for their own advantage. Its remedies, though, are blunt, and the processes for assessing harms will most likely proceed more slowly than the harms themselves.

Markets are ecosystems, and like other ecosystems, there are hidden dependencies everywhere. The harm of Google abusing its monopoly position will not show up first in harm to consumers, but in depressed profits, decreased R&D investment, and lower wages at the web companies to whom Google once directed traffic. For Amazon, it will show up in the increased fees and advertising costs required to show up in product search.

These harms to the supply side of marketplace platforms, with the majority of the gains being captured by the winner of the winner-takes-all model that Silicon Valley has encouraged, do eventually cascade to consumers. But because the pain is widely distributed and because the platforms are not required to report the information that would make it visible, the problem will not be obvious until much of the damage is irreversible.

When the “superstar firms” ruthlessly compete with smaller firms that come up with fresh ideas, not only starving them of talent but often introducing copycat products and services, there is decreased innovation from the market as a whole. Cities are dominated by a new class of highly paid big-company employees driving up housing costs and forcing out lower wage workers; wages and working conditions of workers in less profitable industries are squeezed to drive the growth of the giants. Their very jobs are made contingent and disposable, with inequality baked in from the beginning of their employment. Governments are starved of revenue by giant companies that have mastered the art of tax avoidance. The list is far longer than that.

In the case of social media platforms, manipulation of users for profit has frayed the fabric of democracy and the respect for truth. Silicon Valley, which once harnessed the collective intelligence of its users, now uses its deep knowledge of its users to “trade against them.” (I predicted the broad outline of this turn back in 2007, after conversations with venture capitalist and economist Bill Janeway about what we might learn from Wall Street about the future of the internet.)

Technology is far from the only offender. It is merely the most visible mirror of our values as a society. The extractive behavior the tech giants exhibit has been the norm for modern capitalism since Milton Friedman set its objective function in 1970: “The social responsibility of business is to increase its profits.” This is all the sadder, though, since the tech industry set out to model something better. The generosity of open source software and the World Wide Web, the genius of algorithmically amplified collective intelligence are still there, pointing the way to the Next Economy, but it is an economy we must actively choose, rather than riding the rails of a system that is taking us in the wrong direction.

Prediction: Because platform businesses have failed to regulate themselves, they will have limits placed on their potential for good as well as harm.

It’s a sad time for Silicon Valley, because we are seeing not only the death of its youthful idealism but a missed opportunity. Paul Cohen, the former DARPA program manager for AI, made a powerful statement a few years ago at a meeting of the National Academy of Sciences that we both attended: “The opportunity of AI is to help humans model and manage complex interacting systems.”

That statement sums up so much of the potential that is squandered when firms like Google, Amazon, and Facebook fall prey to the Friedman doctrine rather than setting more ambitious goals for their algorithms.

I’m not talking about future breakthroughs in AI so much as I’m talking about the fundamental advances in market coordination that the internet gatekeepers have demonstrated. These powers can be used to better model and manage complex interacting systems for the good of all. Too often, though, they have been made subservient to the old extractive paradigm.

To explain what I mean requires a small aside.

Free market economists believe that the willingness of producers and consumers to agree on prices at which they will exchange goods or services (in idealized markets that are characterized by perfect competition with no asymmetries of power or information) leads to the best allocation of society’s resources. The solution to complex equations representing supply chains of self-interest is expressed in these market prices. Money, in effect, is the coordinating power behind Adam Smith’s “invisible hand.”

Like the anonymous internet wag who wrote, “The difference between theory and practice is always greater in practice than it is in theory,” economists recognize that perfect competition exists only in theory, that “externalities” exist where costs are borne by people other than the buyer and the seller, and that few markets are completely efficient. The role of the state, in many ways, is to address the shortcomings of the market. Diane Coyle’s book Markets, State, and People gives an excellent account of how economic policy makers think about the trade-offs they make when they intervene. Even at their best, though, the available interventions—taxes, monetary policy, and regulations—are piecemeal and take years or decades to agree on and implement. (Carbon pricing is a case in point.)

Google’s search engine has given us a convincing demonstration of a radically different method for managing an economic system. Constantly refined, dynamic, and infused with AI, Google’s algorithmic systems demonstrate that it is possible to manage an economy in ways not imagined by 20th century economists. 40,000 times a second, 3.5 billion times a day, Google’s centrally managed search performs the magic that, for so long, was thought to be the unique province of decentralized, self-interested actors transacting in priced markets.

In a brilliant stroke, Google built an algorithmic system that uses hundreds of distinct information signals to make the best match between tens of millions of information providers and billions of information consumers—but price is not one of those signals. That is not to say that Google does not participate in the money economy. Far from it. But for Google’s first decade and a half, the priced market of pay-per-click advertising was a sidecar to the primary matching marketplace of search. The initial genius of Google was to run the market coordinated by collective intelligence (organic search) and the market coordinated by money (pay per click advertising) in parallel. And when producers with economic motivations manipulated organic search results for profit but to the detriment of Google’s users, producing pages that satisfied the algorithms but failed to satisfy consumers, Google was ruthless in updating the algorithms to focus on consumer benefit.

To be sure, a great deal of content on the World Wide Web and in social media is produced and consumed with commercial intent, but a remarkable amount is produced entirely without a profit motive. Google economists have told me that only six percent of Google search result pages carry any advertising at all. The other 94% of pages are the product of the joyful exuberance of humanity, creating and sharing for the joy of it. If there has ever been a harbinger of a possible economy of abundance, we can see it in the best of the internet sharing economy.

In recent years, though, Google has increasingly blurred the lines between the two information markets it manages (the price-free market of search and the priced market of advertising). And that has made commercially valuable search results less effective than those that have no purely economic value. That is, Google appears to match information producers and consumers more effectively in the absence of the distorting power of money.

So too Amazon. Unlike Google, Amazon has always used price as an important signal in its search rankings, but price was intelligently combined with measures of collective opinion—what other consumers thought was the best product—to create a market that was more efficient than any previous consumer goods marketplace. But in recent years, with the introduction of search advertising as a major new revenue line, Amazon too has turned away from using the tools of collective intelligence to find the best products for its customers. Its search is now dominated by “featured” products—that is, products that producers have paid to put in front of consumers. With advertising now one of the biggest drivers of Amazon’s profits, it is hard to imagine that the company can remain, as Jeff Bezos has proudly boasted, the most consumer-centric platform on earth. I wrote about this problem at length last year, in “Antitrust regulators are using the wrong tools to regulate big tech.”

So many of the problems that antitrust actions and other regulations are now gearing up to address are, paradoxically, the result of the prime directive by which our economic and legal system governs its corporations: “Thou must maximize profits.”

The notion of maximizing profit is so ingrained in our society that in 2014, when Facebook researchers published a paper called “Experimental Evidence of Massive-Scale Emotional Contagion Through Social Networks,” the response was swift and savage. It was considered a terrible breach of research ethics to test whether the mix of stories in the Facebook news feed made its readers happier or sadder. The reaction was particularly striking because no one seemed to notice that Silicon Valley explicitly celebrates and teaches its entrepreneurs how to manipulate the emotional state of users, calling it “growth hacking” or “A/B testing” or “creating habit-forming products.” No one complains about these experiments. It’s considered a best practice to experiment on your customers as long as it is in pursuit of growth and profits.

Because the cost of those experiments is so low—it’s a sunk cost of the business—experimental mistakes and unforeseen consequences are only to be expected. They become a new class of externality little considered by economists and regulators.

In retrospect, some formal experimentation on emotional contagion and reflection on its implications would have been a good idea. Instead, we continue to run global-scale unsupervised experiments on the power of social media to spread negative emotional contagion for profit, while any effort by the platforms to influence their users in positive directions is still considered by many to be inappropriate intervention, or is abandoned because it might reduce user activity and growth.

For example, during the 2020 US presidential election, Facebook engineers reportedly trained a machine learning algorithm to recognize posts that their users would consider “bad for the world,” but the company found that showing fewer of them reduced the number of user sessions and thus, presumably revenue and profits. So they retrained the algorithm to find the point where “bad for the world” posts were reduced but not by so much that they impacted user sessions. Other changes to optimize for “news ecosystem quality” were put in place for a few weeks leading up to the election, but reversed thereafter.

“Shareholder value” is so ingrained in corporate governance that a special class of corporation, “the public benefit corporation,” has been defined to protect companies that are managed to take other considerations than profit into account. All “normal” companies are expected to treat employees, the environment, and society as costs to be minimized, avoided, or eliminated.

Silicon Valley is a mirror of what is wrong with our economy and corporate governance, not the cause of it, or even the worst exemplar. (Tobacco, oil, and pharma companies vie for the top spot.)

In many ways, regulators can still learn from Silicon Valley. Our economy too is shaped by invisible algorithms and embedded objectives. If regulators can see the analogies between the way Google, Amazon, and Facebook’s algorithms shape their services and the way that law, tax, and monetary policy shape who gets what and why in our society, and why corporate leaders act the way they do, we can use the current moment to improve not only Silicon Valley but the fairness and the goals of our entire economy.

As I wrote last year in “We Have Already Let the Genie Out of the Bottle,” an essay for a Rockefeller Foundation workshop on regulating AI, our corporations and our government and our markets are what science fiction writer Charlie Stross calls “slow AIs.” I made the case that we cannot regulate them without rebuilding the rules by which they operate:

“Attempts at governance…are futile until we recognize that we have built a machine and set it on its course. Instead, we pretend that the market is a natural phenomenon best left alone, and we fail to hold its mechanism designers to account. We need to tear down and rebuild that machine, reprogramming it so that human flourishing, not corporate profit, becomes its goal. We need to understand that we can’t just state our values. We must implement them in a way that our machines can understand and execute.”

Silicon Valley can still lead in this effort. The big platforms must understand their social responsibility to create more value than they capture, focus their algorithmic systems on improving human welfare, find ways to measure and communicate the value that they create, and help our broader society to better “model and manage complex interacting systems.”

The danger of regulatory response that simply tries to turn back the clock and doesn’t take into account the ways technology done right could point the way forward is illustrated by the battle over California’s Proposition 22. Its passage overturned state regulations requiring gig economy companies to treat their workers as employees rather than independent contractors.

Traditional labor protections and benefits assumed a world in which individuals worked for a single employer. An attempt to impose those assumptions on companies reliant on gig workers was seen as an existential threat by those companies, who mounted a massive campaign against the new rules. Their customers agreed, and regulations were rolled back by the will of the public.

The gig economy companies have made some small steps toward flexible benefits on their own, but they are a pale shadow of what they might have been if the companies and their gig workers and their customers, not to mention their regulators, had been working together to build systems that would allow benefits to be managed as dynamically as employment. In the German model of stakeholder capitalism, workers are at the management table rather than pitted against the companies they work for. Is there a 21st century version of stakeholder capitalism yet to be designed, one that is not zero-sum but instead “models and manages complex interacting systems” to find better solutions for all?

As I argued five years ago in “Workers in a World of Continuous Partial Employment,” we need a much more robust benefit system that is centered on the worker, not on the company. The gig economy companies are not outliers. Continuous partial employment has become the norm in much of the economy. A combination of the rise of the Friedman doctrine and the demise of labor unions has reset the balance of power between companies and their workers. The legislative and regulatory response needs to address this power imbalance systematically, across the entire labor economy, using the capabilities of technology to create new models of cooperation between companies and their workers, and a safety net that catches everyone, not just a lucky few.

Climate change and the energy economy

The recent news that Elon Musk is one of the world’s richest people is also a harbinger of the biggest opportunity of the 21st century: to avert climate change. Electric vehicles are the tip of the iceberg. Heating and cooling, agriculture, raw materials and manufacturing—all need reinvention. Climate will reshape residential and office construction, insurance, finance, and where and how food is produced. Massive climate migrations have only just begun; tens or hundreds of millions of people will need to be resettled. Will we offer them shantytowns, or will we help them become settlers building a new, better world?

Prediction: There will be more climate billionaires created in the next two decades than in the internet boom.

With the exception of Musk, many of the already-minted climate billionaires are outside the US, highlighting the way that other countries already have the lead in these industries of the future. Bloomberg recently named a few: China’s Zeng Yuqun, Huang Shilin, Pei Zhenhua, and Li Ping (electric vehicle batteries), Li Zhenguo, Li Chunan, and Li Xiyan (solar panels and films), Lin Jianhua (solar panels and films), and Wang Chuanfu (electric vehicles); Germany’s Aloys Wobben (wind turbines); and Spain’s Jose Manuel Entrecanales (renewable power generation).

There are great fortunes yet to be made, of course. While Impossible Foods CEO Patrick Brown and Beyond Meat founder Ethan Brown (no relation) and Plenty’s Matt Barnard, Bowery’s Irving Fain, or Nordic Harvest’s Anders Riemann are not yet billionaires, it is quite possible that they will be. But for the most part, Silicon Valley entrepreneurs and investors are not leaders in this sector.

In any case, who will get rich helping us transition to a new energy economy is unimportant compared to the question of whether we will summon the political will to make the transition in time to avoid the most disastrous consequences of climate change, which could, at their worst, bring an end to civilization as we know it.

A strong argument can be made that only a crash mobilization of the economy to electrify everything can get us there in time. Saul Griffith, Alex Laskey, and Sam Calisch of the nonprofit Rewiring America have made just that argument. And here, the algorithms that guide our economy to focus on “efficiency” need to be questioned. As economist and former venture capitalist Bill Janeway said to me, mobilizations can get hung up and stalled out due to excessive concern with efficiency as the dominant metric of value. “World War II was won on ‘the momentum of production,’ “ he noted, quoting from The Struggle for Survival, his father Eliot Janeway’s book about the World War II mobilization. “Similarly the WPA put millions to work during the Depression precisely because effective employment—not efficiency—was the dominant goal.”

There are five pillars to Rewiring America’s case for electrification as the answer to our urgent need to limit greenhouse gas emissions:

1. Electrifying everything requires only half as much energy as our current system. Saul and his team worked with the US Department of Energy in 2018 to create an interactive map of all the source-to-use energy flows in America. This map of our energy economy was started under the Nixon administration, but its true implications are only now being realized. One of the surprising consequences of their analysis is that half the energy we use is spent collectively on things like mining and transporting fossil fuels, and in thermoelectric losses from converting them to electricity, to heat, or to movement. Direct electrification of as much of our economy as possible is not only achievable but also the fastest way to avert climate disaster.

2. We need to reconceive solar panels, batteries, electric cars, and electric appliances as part of our national energy infrastructure, even when they are on or in people’s homes, rather than thinking of infrastructure as something owned only by utilities or the government. Electric heat pumps can be used for both hot water and home heating; hot water storage can in effect act as a battery, heating up with solar electricity during the day and giving heat back at night. We won’t balance a future renewables-heavy grid without using local (i.e., home and business) batteries and thermal loads (water and space heat) as part of the overall demand response and storage.

3. Markets won’t move fast enough without a World War II-style mobilization of private industry. We need a heroic 4–5 year effort to get to 100% transformation of our energy infrastructure. Otherwise, we will have to wait for the natural replacement rate on infrastructure, which will take decades that we don’t have. That heroic 4–5 year effort gets us to the scale of production appropriate to enable 100% adoption of the solution technologies, which will then require a consistent 10–20 year rollout beyond that initial ramp-up period.

4. Electrifying the US will create jobs—lots of them. Rewiring America estimates that such an effort could, at peak, create as many as 25 million US jobs, and 5 million ongoing jobs in the new industries. The cost of the retrofit will be high, but so will the payoff, in both jobs and in savings to consumers.

Rooftop solar can produce at most 25% of the total needs of a fully electrified economy, so there’s still plenty of room and need for grid-scale solar—the electrified economy will require 3x the capacity of the current grid—but local is the cheapest energy and the best way to pass savings to the consumer, as well as to create highly localized jobs across the country.

Rooftop solar jobs are of necessity geographically decentralized, potentially enabling an ecosystem of small local firms rather than rewarding a few giants.

5. Who gets the financial benefit of this massive investment—utilities, solar installers, or consumers—depends on interest rates.

“The miracle technology is much more likely to be finance than it is to be fusion,” Saul said in a recent presentation. Arguably, it was the invention of the auto loan by Alfred P. Sloan of General Motors and the later financial innovation by the Roosevelt administration of the Federal Housing Authority and the home mortgage that created the US middle class, he noted. “Mortgages are time machines that let you have the future you want today.” We need something similar for the electrification transformation. Otherwise, “only rich people can afford to decarbonize today.”

Utilities already have access to low-cost loans. But consumers don’t, and if you want to create both jobs and cost savings for consumers, low-cost interest rates for home electrification are the best way to do it. Otherwise, the savings all get captured by middlemen, or by utilities, and adoption is much slower.

This observation is entirely in line with my broader point that regulations and the tax code play much the same role in shaping who gets what and why in markets as do the controlling algorithms in online platforms.

The end of casino capitalism?

The final, and perhaps most important, reason why Silicon Valley as we know it may be over is that its current incarnation is a product of the extraordinarily cheap capital of the years since the global financial crisis of 2009.

There are two economies, often confused: the operating economy, in which companies make and sell products and services, and the betting economy, in which wealthy people bet on which companies will win and which will lose in the beauty contest that stock markets have become. In the operating economy, the measure of success is, as Nick Hanauer and Eric Beinhocker memorably put it, “the solution to human problems.” Companies compete to solve those problems more effectively and earn a profit thereby. Along the way, they employ people productively, create valuable new goods and services, and contribute to their communities.

In the betting economy, the measure of success is stock price, the higher the better. Fueled by massive money creation by central banks, capital is abundant (for those who, by virtue of existing wealth, already have access to it), and traditional sources of return, such as interest on loans or ROI on investment in plants and equipment or employees, are dwarfed by the potential returns that can be achieved by playing on the madness of crowds. What can you call it but a bubble when the median valuation of this past year’s tech IPOs was 24 times trailing revenue, while tech IPOs during most of the past decade were only valued at about six times trailing revenue. Data collected by University of Florida professor Jay Ritter shows that it’s even worse than it appears: only 16% of 2020’s tech IPOs had any profits at all.

Capital markets do play an important role in our society. Bets on an unknown future are an important way to fund innovation and to build out infrastructure in advance of the prosperity that it will bring once that innovation has been widely deployed. But in today’s financialized economy, the returns on betting for its own sake have grown far faster than the returns on true operating investment.

There are many who will argue that the enormous payoffs coming to today’s entrepreneurs and investors are the result of their world-changing innovations. History suggests otherwise. There was plenty of innovation when the returns to investors and entrepreneurs were a fraction of what they are today.

Silicon Valley is named for the semiconductor manufacturing companies that became the foundation of all that followed. Intel, one of the most successful of those companies, went public in 1971 with a valuation of about $58 million (about $372 million in today’s dollars). Intel had a small profit when it went public, but it went on to earn hundreds of billions of dollars in operating profit over the succeeding decades. Apple and Microsoft, the standard bearers of the next generation of Silicon Valley companies, were also profitable at IPO. Two decades later, Google too was highly profitable when it went public, and while Amazon was one of the first companies to legitimize the profitless IPO, its losses were falling as it grew. All have turned into companies that generate enormous profits in the operating economy.

Few of the companies in the recent crop of Silicon Valley companies can make that claim. At its IPO early in 2020, Palantir had prior year revenues of $743 million, on which it posted a loss of $576 million. Uber went public in 2019 with an operating loss of over $3 billion on $11 billion in revenue. When DoorDash went public, it had revenues of $1.92 billion for the trailing nine months, on which it had a net loss of $149 million. All these companies have valuations in the tens of billions, making their founders and investors very rich, despite not making any money at all in the operating economy. In many cases, the money invested in these companies was used to create the illusion of growth, acquiring customers below the cost of delivering services to them. It is money invested in the promise of more money, a kind of Ponzi scheme decoupled from the operating economy.

Intel’s stock market investors were making a rational bet that a world-changing technology would earn a huge stream of future profits. Palantir’s, Uber’s, and DoorDash’s investors were betting on how other investors might value their stocks, much as 16th century Dutch investors bet on the “value” of unique tulips or mid-19th century British investors bet on the prospects for railroads in distant countries, many of which were never built. Some of these companies may eventually turn an operating profit, but it is likely that when they do, investors will realize that those profits don’t justify the sky-high valuations, which will then come back down to earth. As Benjamin Graham, the father of the style of value investing favored by Warren Buffett, is reported to have said, “In the short run, the market is a voting machine. In the long run, it is a weighing machine.”

Were Gordon Moore and Robert Noyce, the founders of Intel, less motivated to build world-changing products because the proceeds were orders of magnitude less than they are for today’s Silicon Valley entrepreneurs? I suspect that it is the other way around. The easy profits from today’s financial betting markets encourage unproductive innovation. I’d take Gordon Moore over WeWork’s Adam Neumann any day. When investors and entrepreneurs who promise future innovation but are unable to deliver it still walk away with billions, something is seriously wrong.

As John Maynard Keynes wrote in his General Theory during the depths of the Great Depression, “Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation. When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.”

The problem is that money “invested” in the betting economy is not really invested. It is spent, just like money at the gaming table. When the WeWork bubble popped, the money SoftBank had spent propping up its valuation might just as well have gone up in smoke. The end of this process could look something like the financial crisis of 2009. Money invested in the collateralized debt obligations of the first decade of this century was not backed by true worth in the operating economy, so when the CDOs went bust, the money simply vanished.

Prediction: When the bubble ends, greater opportunities will remain.

One of the gifts—if you can call it that—of crises like the pandemic and climate change is that they may teach us that we no longer have time for frivolity. We need our investment capital to flow back to the operating economy.

There is a robust strategy for investors and entrepreneurs: Work on stuff that matters. Invest in solving problems. Make a real difference in people’s lives. You will know you have done that when operating profits fairly earned, not stock market gains, are your measure of investment success.

Two of the big areas of innovation that I highlight in this essay—life sciences and climate change—require large amounts of real investment capital. Unlike money invested in internet companies that used it to buy unprofitable growth, money invested in Tesla was used to build factories, to manufacture cars and electric batteries, and to roll out national charging networks.The path to high returns may take longer, but the need is real, and so is the value created.

Solving global crises requires the best of what we have to offer. If the best way to predict the future is to invent it, it’s time we got busy. Which world do we want to invent? It’s up to us.