Last year, our report on cloud adoption showed that companies were moving quickly to adopt the cloud: 88% of our respondents from January 2020 said that they used the cloud, and about 25% said that their companies planned to move all of their applications to the cloud in the coming year.

This year, we wanted to see whether that trend continued, so we ran another online survey from July 26, 2021, to August 4, 2021. Since the 2020 survey was taken when the pandemic was looming but hadn’t yet taken hold, we were also curious about how the lockdown affected cloud adoption. The short answer is “not much”; we saw surprisingly few changes between January 2020 and July 2021. Cloud adoption was proceeding rapidly; that’s still the case.

Executive summary

- Roughly 90% of the respondents indicated that their organizations are using the cloud. That’s a small increase over last year’s 88%.

- The response to the survey was global; all continents (save Antarctica) were represented. Compared to last year, there was a much higher percentage of respondents from Europe (33%, as opposed to 11%) and a lower percentage from North America (42%).

- In every industry, at least 75% of the respondents work for organizations using the cloud. The most proactive industries are retail & ecommerce, finance & banking, and software.

- Amazon Web Services (AWS) (62%), Microsoft Azure (48%), and Google Cloud (33%) are still the big three, though Amazon’s market share has dropped slightly since last year (down from 67%). Most respondents use multiple cloud providers.

- Industry to industry, we saw few differences in cloud providers, with two exceptions: Azure is used more heavily than AWS in the government and consulting & professional services sectors.

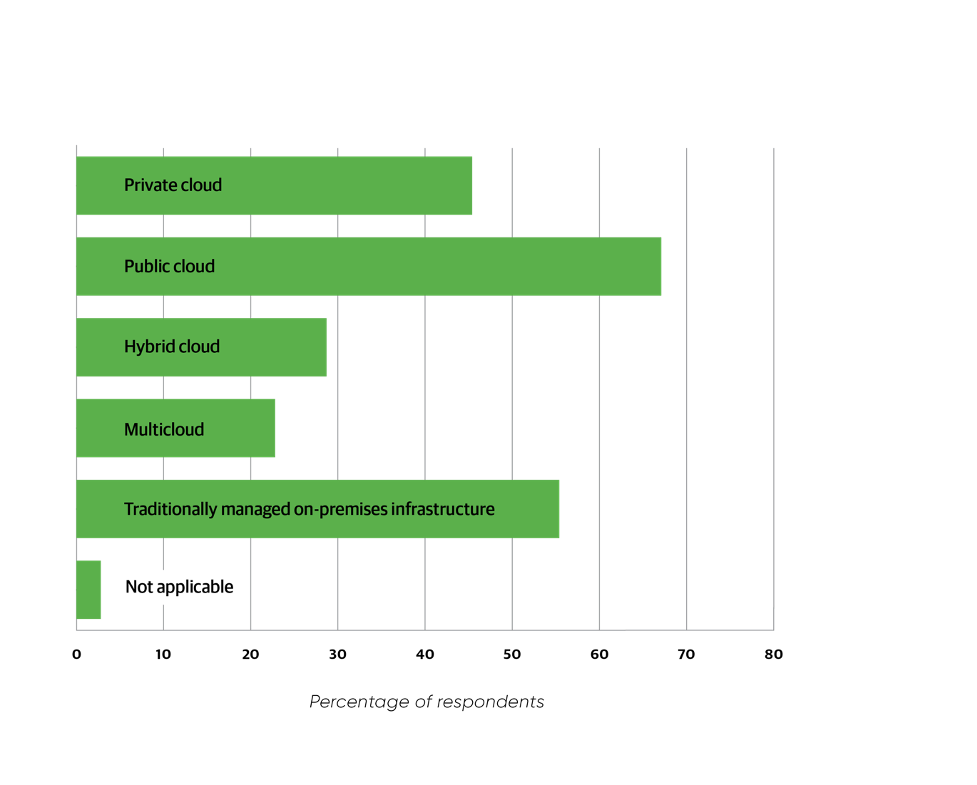

- Two-thirds of respondents (67%) reported using a public cloud; 45% are using a private cloud; and 55% are using traditionally managed on-premises infrastructure.

- Almost half (48%) said they plan to migrate 50% or more of their applications to the cloud in the coming year. 20% plan ti migrate all of their applications.

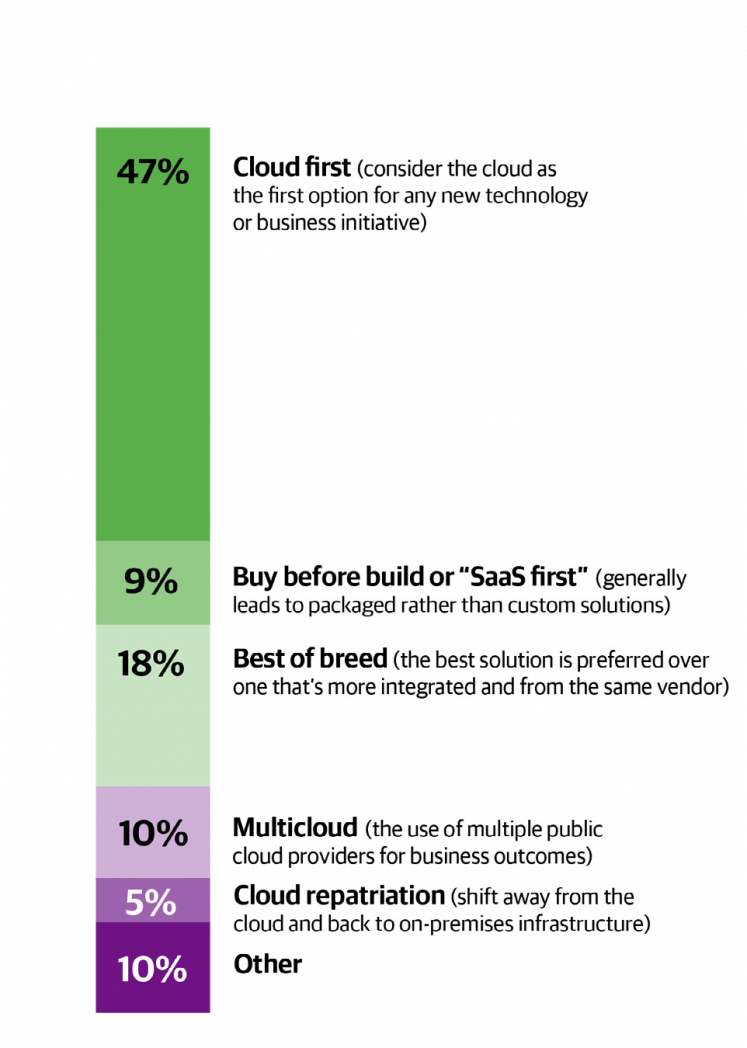

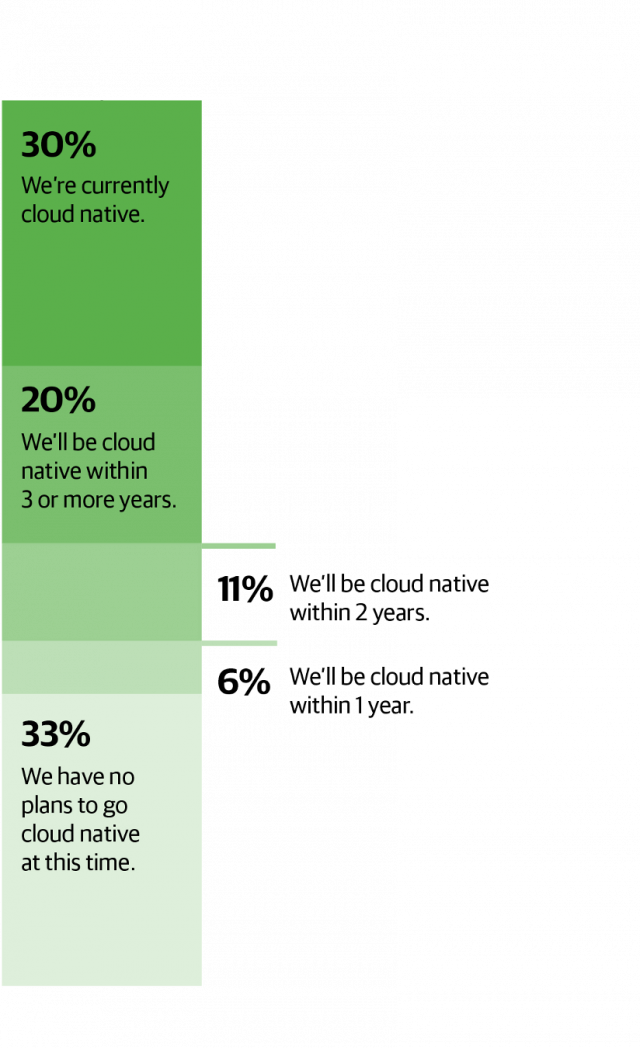

- 47% said that their organizations are pursuing a cloud first strategy. 30% said that their organizations are already cloud native, and 37% said that they plan to be cloud native within three or more years. Only 5% are engaged in “repatriation” (bringing cloud applications back to on-premises infrastructure).

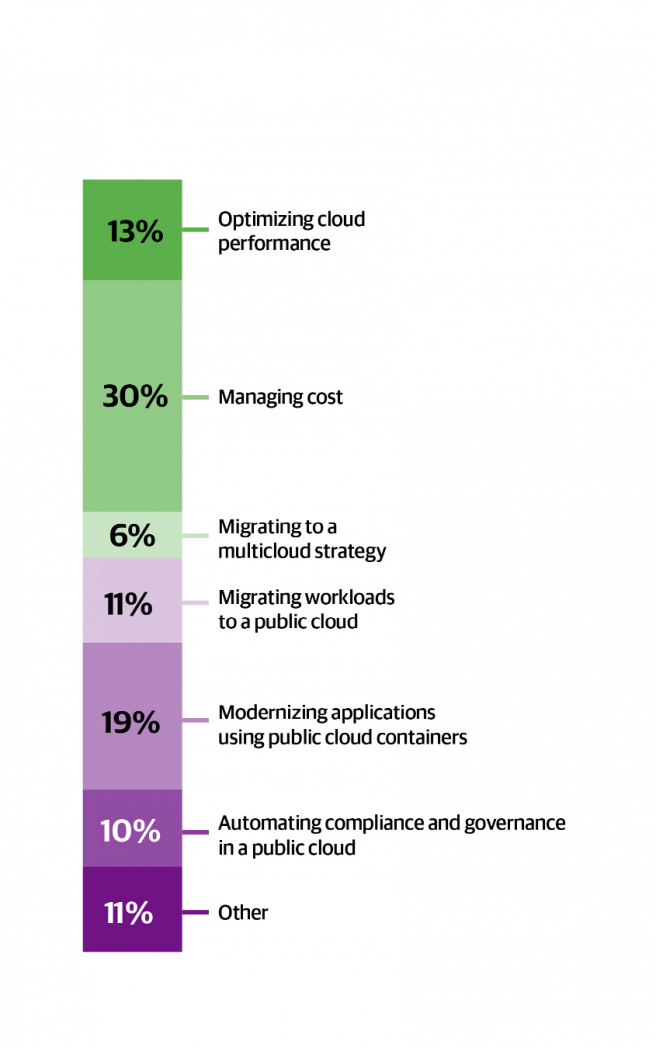

- Among respondents who are using the cloud, the biggest concern is managing cost (30%). Compliance is a relatively minor concern (10%) and isn’t the most significant concern even in heavily regulated sectors such as finance & banking (15%), government (19%), and healthcare (19%).

- When asked what skills organizations needed to succeed, respondents were divided fairly evenly, with “cloud-based security” (59%) and “general cloud knowledge” (54%) the most common responses.

Demographics: Who responded

The survey was sent to recipients of O’Reilly’s Programming and Infrastructure & Ops Newsletters, which together have 436,000 subscribers. 2,834 respondents completed the survey.

The respondents represent a relatively senior group. 36% have over 10 years’ experience in their current role, and almost half (49%) have over seven years’ experience. Newer developers were also well-represented. 23% have spent one to three years in their current position, and 8% have spent under one year.

Parsing job titles is always problematic, given that the same position can be expressed in many different ways. Nevertheless, the top five job titles were developer (4.9%1), software engineer (3.9%), CTO (3.0%), software developer (3.0%), and architect (2.3%). We were surprised by the number of respondents who had the title CTO or CEO. Nobody listed CDO or chief data officer as a title.

Aggregating terms like “software,” “developer,” “programmer,” and others lets us estimate that 36% of the respondents are programmers. 21% are architects or technical leads. 10% are C-suite executives or directors. 8% are managers. Only 7% are data professionals (analysts, data scientists, or statisticians), and only 6% are operations staff (DevOps practitioners, sysadmins, or site reliability engineers).

The respondents came from 128 different countries and were spread across all continents except for Antarctica. Most of the respondents were from North America (42%) and Europe (33%). 13% were from Asia, though that almost certainly doesn’t reflect the extent of cloud computing in Asia.

In particular, there were few respondents from China: only 8, or about 0.3% of the total. South America, Oceania, and Africa were also represented, by 6%, 4%, and 2% of the respondents, respectively. These results are significantly different from last year’s. In 2020, two-thirds of the respondents were from North America, and only 11% were from Europe. The other continents showed little change. Last year, we noted that European organizations were reluctant to adopt the cloud. That’s clearly no longer true.

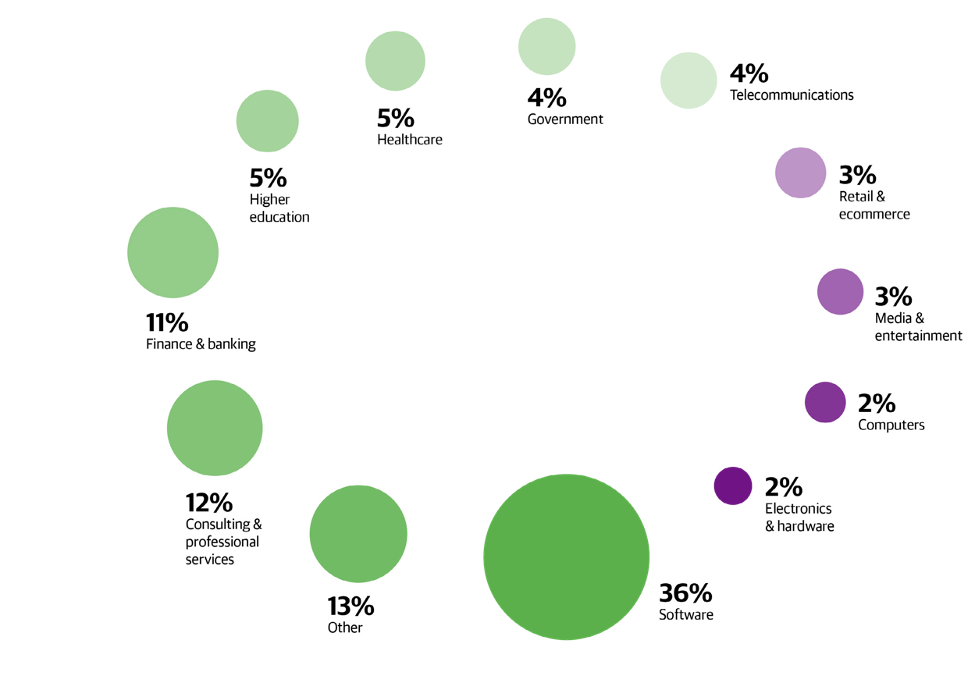

Cloud users are spread throughout the industrial spectrum. Respondents to our survey were clustered most strongly in the software industry (36%). The next largest group comprises those who replied “other” (13%), and they are indeed scattered through industries from art to aviation (including some outliers like prophecy, which we never knew was an industry). Consulting & professional services (12%) was third; we suspect that many respondents in this group could equally well say they were in the software industry. Finance & banking (11%) was also well- represented. 5% of the respondents work in healthcare; another 5% were from higher education; 4% were in government; and a total of 4% work in electronics & hardware or computers (2% each). Surprisingly, only 3% of the respondents work in retail & ecommerce; we would have expected Amazon alone to account for that.

These results are very similar to the results from last year’s survey, with two major differences: this year, an even larger percentage of our respondents were from the software industry (23% in 2020), and a significantly larger group classified their industries as “other” (20%).

What does this mean? Less than it seems. We have to remind both ourselves and our readers that the number of respondents in any sector reflects, first, the size of that sector; second, our mailing lists’ penetration into that sector; and only third, cloud usage in that sector. The fact that 35% of the respondents are in the software industry while only 5% are in healthcare doesn’t by itself mean that the cloud has penetrated much more deeply into software. It means that the healthcare industry has fewer readers of our newsletters than does the software industry, hardly a surprising conclusion. To estimate cloud usage in any given sector, you have to look only at that sector’s data. What it says is that our conclusions about the software industry are based on roughly 1,000 respondents, while conclusions about the healthcare industry are only based on about 150 respondents, and are correspondingly less reliable.

The big picture

The big picture won’t surprise anyone. Almost all of the respondents work for organizations that are using cloud computing; only 10.3% answered a question asking why their organization doesn’t use cloud computing, implying that cloud usage is 89.7%. Likewise, when asked what cloud provider they’re using, 10.7% said “not applicable,” suggesting cloud usage of 89.3%. We can get a third fix on cloud usage by looking at a later question about cloud technologies. We asked whether respondents are using public clouds, private clouds, hybrid clouds, multiclouds, or traditionally managed

infrastructure. Respondents were allowed to select multiple answers, and most did. However, respondents whose organizations aren’t using any cloud technology would check “traditionally managed infrastructure.” Those respondents amounted to 7.5% of the total, suggesting 92.5% of the respondents are using the cloud in some form. Therefore, we can say with some confidence that the number of respondents whose organizations are using the cloud is somewhere between 89% and 93%.

These figures compare with 88% from our 2020 survey—a change that may well be insignificant. However, it’s worth asking what “insignificant” means: would we expect the number of “not using” responses to be near zero? On one hand, we’re surprised that there hasn’t been a larger change from year to year; on the other hand, when you’re already near 90%, gaining even a single percentage point is difficult. We can be somewhat (only somewhat) confident that there’s a genuine trend because we asked the same question three different ways and got similar results. An additional percentage point or two may be all we get, even if it doesn’t allow us to be as confident as we’d like.

Did the pandemic have an effect? It certainly didn’t slow cloud adoption. Cloud computing was an obvious solution when it became difficult or impossible to staff on-premises infrastructure. You could argue that the pandemic wasn’t much of an accelerant either, and it would be hard to disagree. Once again though, when you’re at 88%, gaining a percentage point (or two or three) is an achievement.

AWS, Azure, and Google Cloud: The big three and beyond

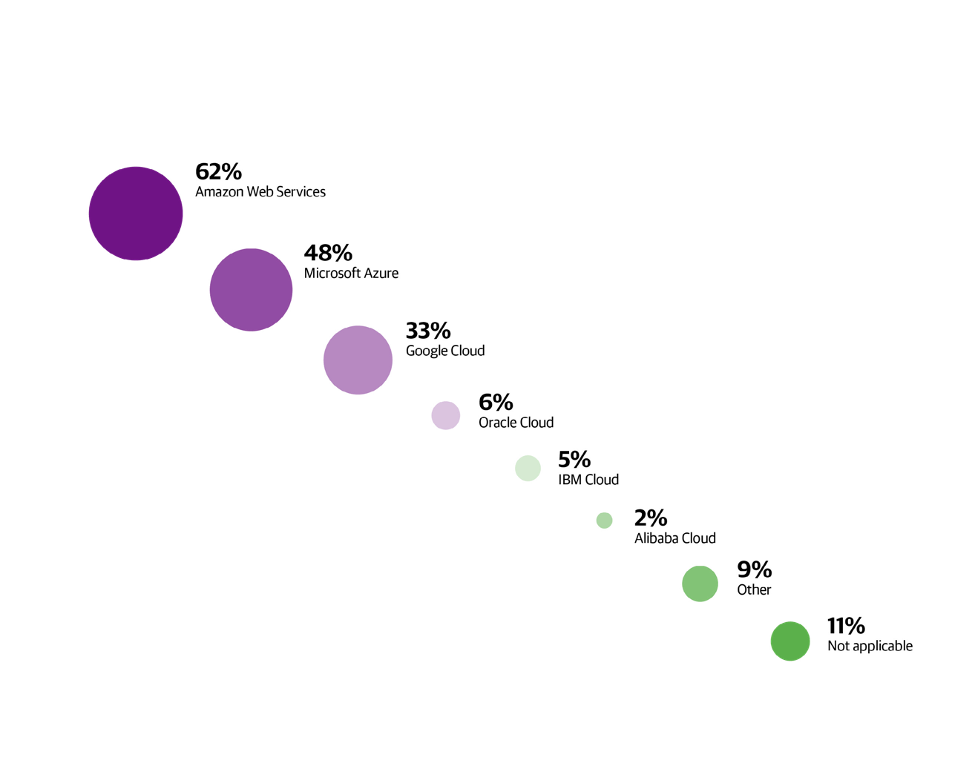

The big three in cloud computing are Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, used by 62%, 48%, and 33% of the respondents, respectively. (Because many organizations use multiple providers, respondents were allowed to select more than one option.) Oracle Cloud (6%), IBM Cloud (5%), and Alibaba Cloud (2%) took fourth through sixth place. They have a long way to go to catch up to the leaders,

although Oracle seems to have surpassed IBM. It’s also worth noting that, although Alibaba’s 2% seems weak, we expect Alibaba to be strongest in China, where we had very few respondents. Better visibility into Chinese industry might change the picture dramatically.

9% of the respondents selected “other” as their cloud provider. The leading “other” provider was Digital Ocean (1.4%), which almost edged out Alibaba. Salesforce, Rackspace, SAP, and VMware also appeared among the “others,” along with the Asian provider Tencent. Many of these “other” providers are software-as-a-service companies that don’t provide the kind of infrastructure services on which the big three have built their businesses. Finally, 11% of the respondents answered “not applicable.” These are presumably respondents whose organizations aren’t using the cloud.

Compared to last year, AWS appears to have lost some market share, going from 67% in 2020 to 62%. Microsoft Azure and Google Cloud remain unchanged.

Cloud usage by industry

One goal of our survey was to determine how cloud usage varies from industry to industry. We felt that the best way to answer that question was to go at it in reverse, by looking at the respondents who answered the question “What best describes why your organization doesn’t use cloud computing?” (which we’ll discuss in more detail later). Our results provided other ways to answer this question—for example, by looking at “not applicable” responses to questions about cloud providers. All approaches yielded substantially the same answers.

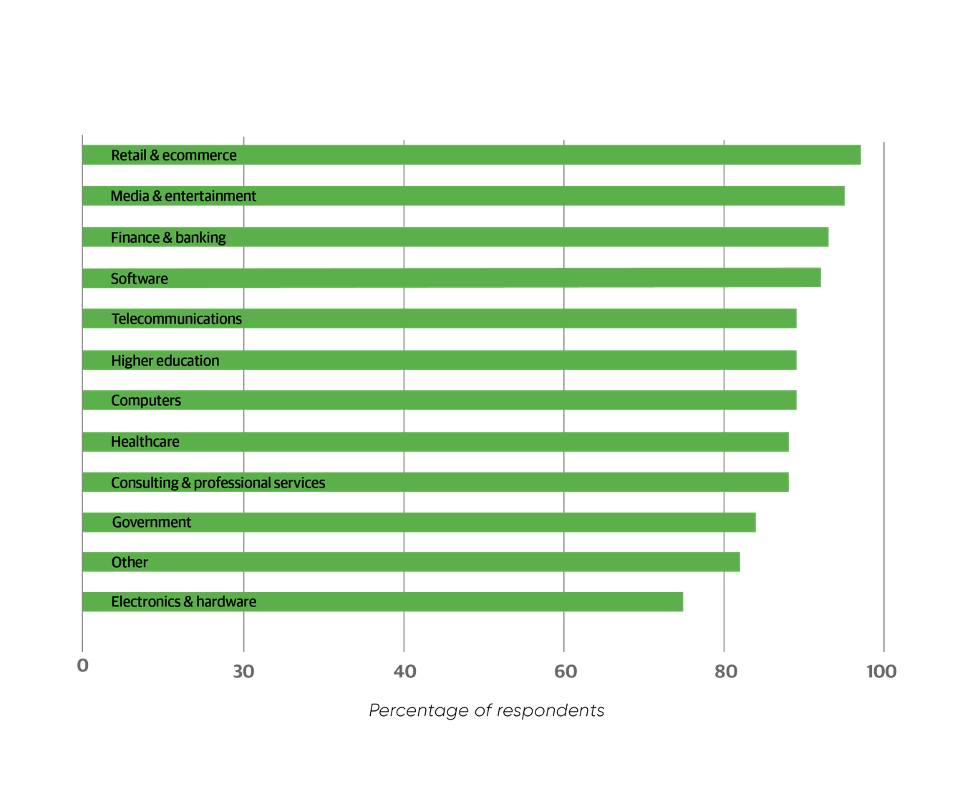

We found that retail & ecommerce, media & entertainment, finance & banking, and software stand out as the industry sectors with the highest cloud use. Only 3.1% of the respondents from the retail & ecommerce sector answered this question, indicating that cloud usage was close to universal (96.9%). 5.1% of the respondents in media & entertainment, 7.2% of the respondents in finance & banking, and 7.5% of the respondents in software answered this question, suggesting 94.9%, 92.8%, and 92.5% cloud usage, respectively. Most industries (including healthcare and higher education) clustered around 10% of organizations that aren’t using the cloud, or 90% cloud usage. The most cloud-averse industries were electronics & hardware (with 25% indicating that they don’t use the cloud) and government (16% not using). But consider: 25% of respondents indicating that they don’t use the cloud implies that 75% of the respondents do. While we saw variation from industry to industry, cloud users are a solid majority everywhere.

Can we get beyond the numbers to the “why”? Perhaps not without a much more detailed survey, but we can make some guesses. Although we had few respondents from the retail & ecommerce sector, it’s important to note that this industry is where the cloud took off: AWS began when Amazon started selling “excess capacity” in its data centers. Jeff Bezos paved the way for this with his famous “API mandate” memo, which required all software to be built as collections of services. In media & entertainment, Netflix has been very public about its cloud strategy. The company relies on the cloud for all of its scalable computing and storage needs, an approach initially undertaken as a way of avoiding on-premises infrastructure as a single point of failure.

But history often counts for little in tech. What’s more important is that retail & ecommerce is a sector subject to huge fluctuations in load. Black Friday is approaching as we publish this; need we say more? If your ecommerce site slows to a crawl under heavy load, you lose sales. The cloud is an ideal solution to that problem. No CIO wants to build an on-premises data center that can handle 100x changes in load. The same is true for Netflix, though perhaps not to the same degree: a new movie release almost certainly creates a spike in traffic, possibly a huge one. And in the

past few years, movie studios, vendors like Amazon, and many others in the industry have realized that the future of movies lies in selling subscriptions to streaming services, not cinema tickets. Cloud technologies are ideal for streaming services.

Just about every software company, from startups to established vendors like Microsoft and Adobe, now offers “software as a service” (SaaS), an approach arguably pioneered by Salesforce. Whether or not subscription services are the future of software, most software companies are betting heavily on cloud offerings, and they’re building those offerings in the cloud.

Understanding why banks are moving to the cloud may be more difficult, but we think it comes down to focusing on your core competence. The finance & banking industry has historically been very conservative, with organizations going for decades without significant change to their business models or procedures. In the past decade, that stability has gone out the window. Financial service companies and banks are now offering online and mobile products, investment services, financial planning, and much more. The best way to service these new applications isn’t by building out legacy infrastructure designed to support legacy applications largely unchanged since the beginning of computing; it’s by moving to an infrastructure that can scale on demand and that can be quickly adapted to support new applications.

Our next step was to look at the cloud providers to determine what providers are used by each industry. Are some providers used more widely in certain industries than in others? When we looked at this question, we saw a familiar pattern: AWS is the most widely used, followed by Microsoft Azure and Google Cloud. AWS dominates media & entertainment (79%) and is the most commonly used provider in every sector except for consulting & professional services (58%, compared to Azure at 60%) and government (52%, compared to Azure at 59%).

In addition to government and consulting & professional services, Azure is widely used in finance & banking (55%). That shouldn’t be surprising given the historical prominence of Microsoft Office in this industry.

Google Cloud was third in every sector except for media & entertainment (35%), where it edged out Azure. It’s strongest in the consulting & professional services sector (41%) and the relatively small computers sector (40%) and weakest in government (16%), healthcare (25%), and finance & banking (29%).

Electronics & hardware had the greatest number of respondents who answered “not applicable” (28%). Although there were surprisingly few respondents from the retail & ecommerce sector, it had the fewest (3%) respondents who answered “not applicable.”

AWS’s, Microsoft Azure’s, and Google Cloud’s shares were closest to each other in the higher education sector (49%, 43%, and 39%, respectively).

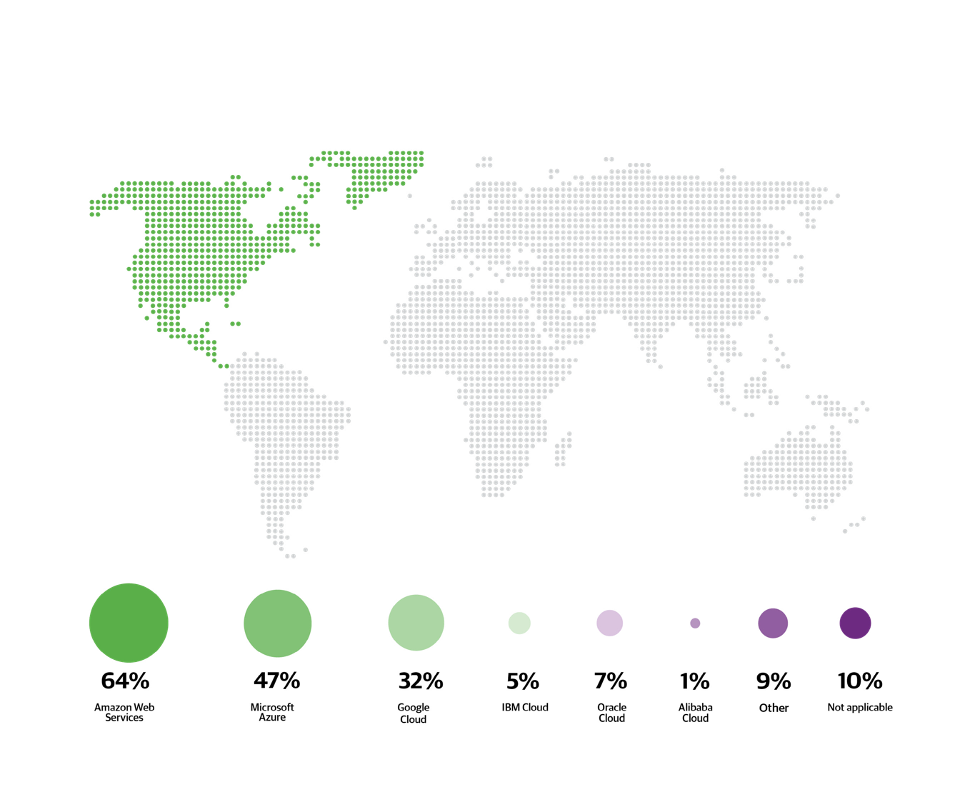

Cloud usage by geography

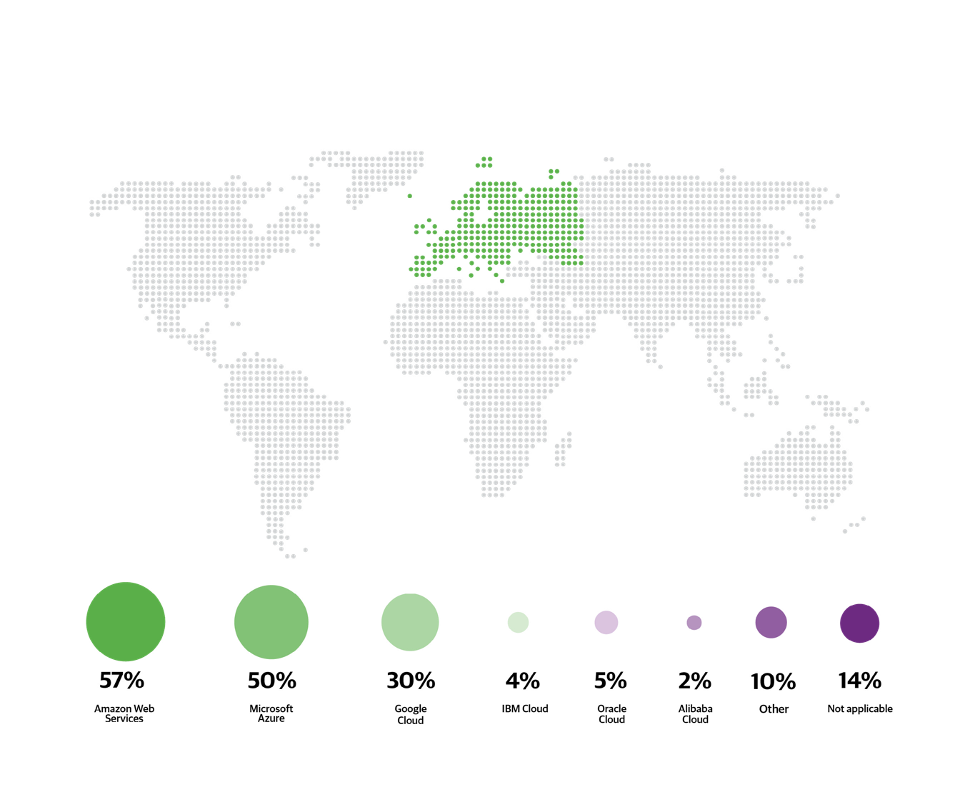

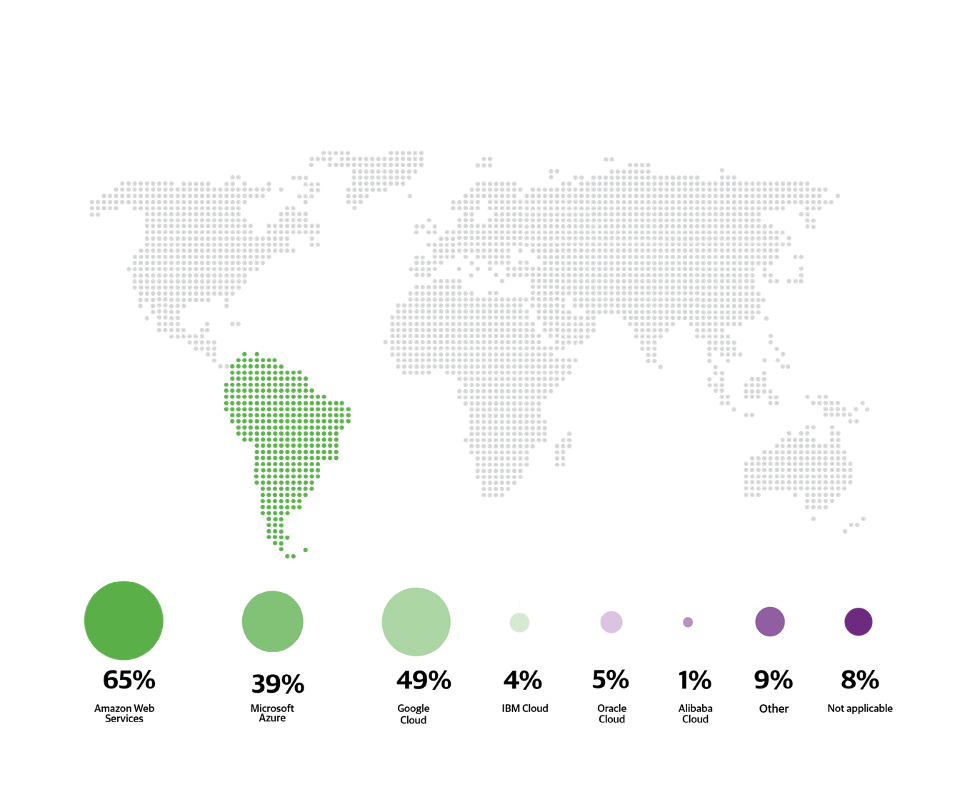

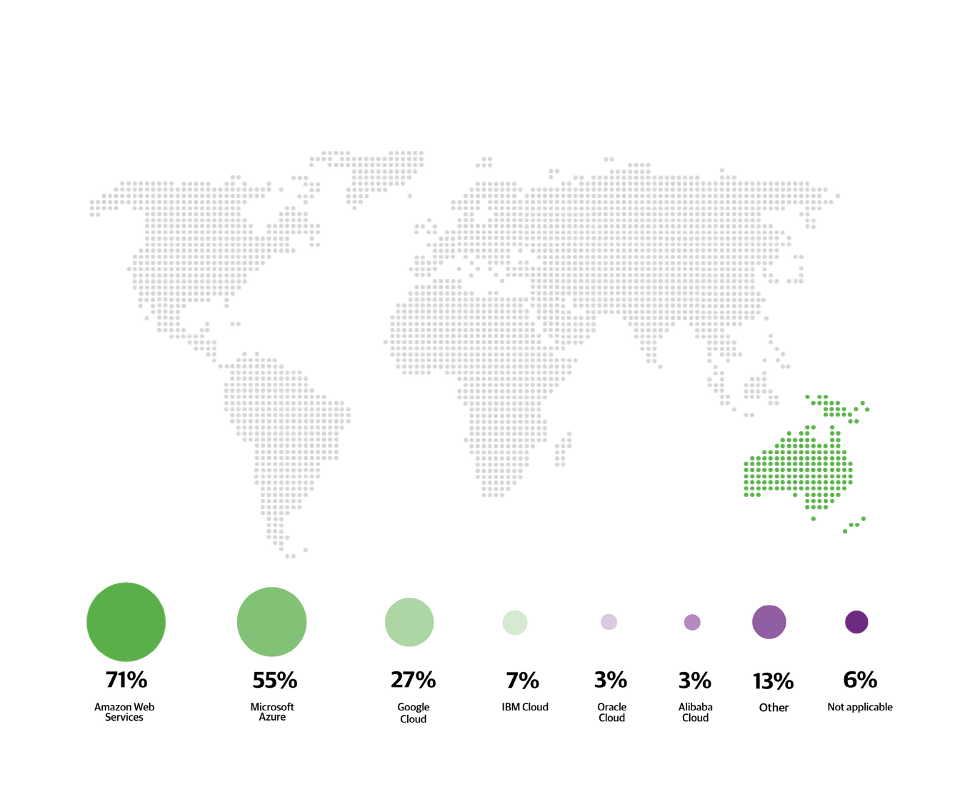

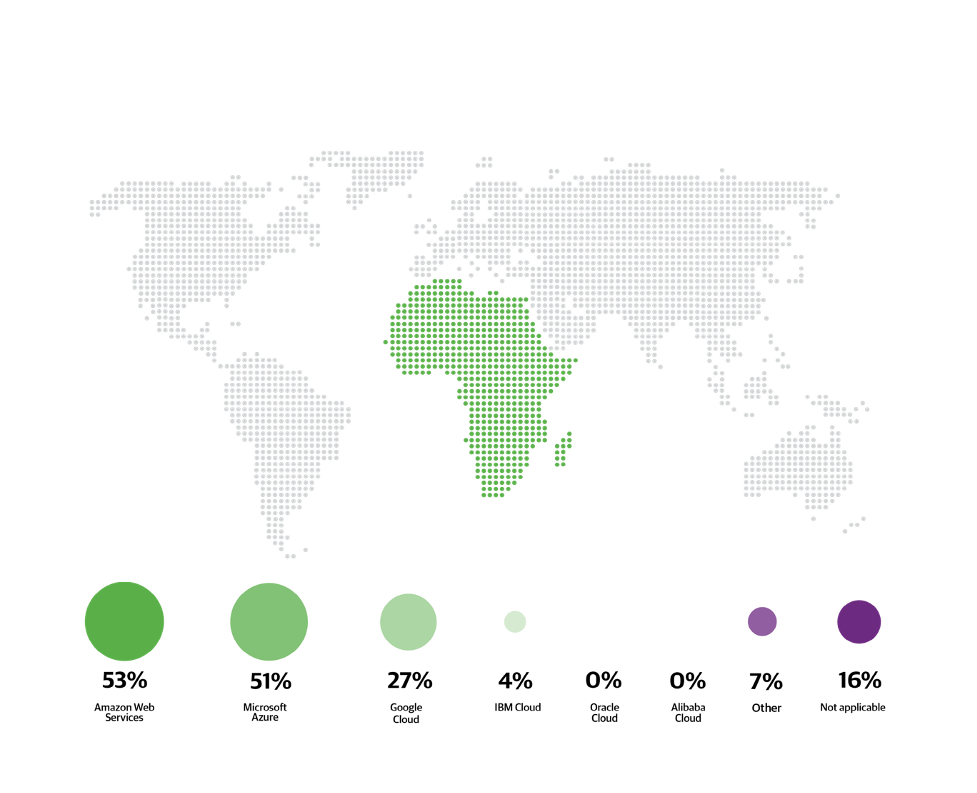

We wondered whether the usage of different cloud providers varied by continent: are some cloud providers more popular on some continents than on others? By and large, the answer is no. AWS leads by a substantial margin on every continent, and Microsoft Azure and Google Cloud take second and third place, though their relative strengths vary. Google Cloud is significantly stronger in South America (49%) and Asia (40%) than on the other continents. Azure is strongest in Oceania (55%), Africa (51%), and Europe (50%).

Alibaba Cloud is a somewhat more common choice in Asia (5%) and Oceania (3%), but not enough to change the picture significantly. Remember, though, that we had few respondents from China, where we suspect that cloud adoption is significant and Alibaba is a strong contender.

Although the percentages are relatively small, it’s also worth noting that more respondents in Oceania are using “other” providers (13%), possibly because their relative geographic isolation makes local cloud providers more attractive, and that a large percentage of respondents in Europe answered “not applicable” (14%), indicating that cloud adoption may still be lagging somewhat.

North America

Europe

Asia

South America

Oceania

Africa

While we’ll discuss multicloud in more detail later, it’s interesting that this diagram gives some hints about the extent of deployment on multiple clouds. Remember that respondents could and frequently did select multiple cloud providers, so the total percentage in any continent (always greater than 100%) is a very rough indicator of multiple cloud deployments. By that measure, Africa (totaling 142%) and Europe (158%) have the fewest multiple cloud deployments; Oceania (179%) has the most.

Public or not

We asked our respondents what cloud technologies they’re using. 67% (two-thirds) are using a public cloud provider, such as AWS, versus 61% in 2020. 45% are using a private cloud—private infrastructure (on-premises or perhaps hosted) that’s accessed using cloud APIs—which represents a 10% increase over 2020 (35%). And 55% are using traditionally managed on-premises infrastructure, as opposed to 49% last year.

Respondents could select multiple answers, and many did. It’s not surprising that so many organizations appear to be using on-prem infrastructure; we’re actually surprised that the number isn’t higher, since in any cloud transformation, the remnants of traditional infrastructure are necessarily the last thing to disappear. And most companies aren’t that far along in their transformations. Moving to the cloud may be an important goal, and cloud resources are probably already providing critical infrastructure. But eliminating all (or even most) traditional infrastructure is a very heavy lift.

That’s not the whole story. 29% of the respondents said they’re using a hybrid cloud (a significant drop from last year’s 39%), and 23% are using multicloud (roughly the same year over year). A multicloud strategy builds systems that run across multiple cloud providers. Hybrid cloud goes even farther, incorporating private cloud infrastructure (on-premises or hosted) running cloud APIs. When done correctly, multiclouds and hybrid clouds can provide continuity in the face of provider outages, the ability to use “the best tool for the job” on different application workloads (for example, leveraging Google Cloud’s AI facilities), and easier regulatory compliance (because sensitive workloads can stay on private systems).

Therefore, respondents who selected “hybrid cloud” should also have selected “public cloud” and “private cloud” (or, possibly, “traditional infrastructure”). Indeed, that’s what we saw. Only 11% of the respondents who selected “hybrid cloud” didn’t select any other types—and we’d bet that’s because they assumed that “hybrid” implied the others. 27% of those who selected “hybrid” selected all five types, and the remainder selected some combination of the five options. The same was true for respondents who selected “multicloud”: only 4% selected “multicloud” by itself. (“Multicloud” and “hybrid cloud” were frequently selected together.)

We’re puzzled by the difference between 2020 and 2021. An increase in the use of public clouds, private clouds, and even traditional infrastructure makes sense: users have clearly become more comfortable mixing and matching infrastructure to suit their needs. We don’t expect the use of traditional infrastructure to disappear. But why did usage of hybrid clouds drop? We don’t have a good answer, except to note that many respondents (indeed, a third of the total) who didn’t select either “multicloud” or “hybrid cloud” still selected multiple infrastructure types. A combination of public cloud and traditional infrastructure was most common, followed by public cloud, private cloud, and traditional infrastructure. These mixtures indicate that many respondents are clearly using some form of multicloud or hybrid cloud, even if they aren’t including that in their responses.

We can’t ignore the slip in the percentage of respondents answering “hybrid cloud.” That may indicate some skepticism about this most ambitious cloud architecture. It could even be an artifact of the pandemic. We’ve already said that the pandemic gave many companies a good reason to move on-premises infrastructure to the cloud. But while the pandemic may have been a good time to start cloud transformations, it was arguably a poor time to start very ambitious projects. Can we imagine CTOs saying, “Yes, we’re moving to the cloud, but we’re keeping it as simple as possible” Definitely.

We also looked at what types of cloud technologies were attractive to different industries. Public clouds are most heavily used in retail & ecommerce (79%), media & entertainment (73%), and software (72%). Hybrid clouds are strongest in consulting & professional services (38%), possibly because consultants often play a role in integrating different cloud providers into a seamless whole.Private clouds are strongest in telecommunications (64%), which was the only sector in which private clouds led public clouds (60%).

Traditionally managed on-premises infrastructure is most widely used in government (72%). Other industries where the number of respondents using traditional infrastructure equaled or exceeded the number reporting any form of cloud infrastructure included higher education (61%), healthcare (61%), telecommunications (67%), computers (65%), and electronics & hardware (58%).

When asked about their organization’s cloud strategy, almost half of the respondents (47%) answered “cloud first,” meaning that wherever possible, new initiatives consider the cloud as the first option. Only 5% selected “cloud repatriation,” or bringing services that were previously moved to the cloud back in-house. 10% indicated a multicloud strategy, where they work with multiple public cloud providers; and 9% indicated that their strategy is to use software-as-a-service cloud providers where possible (e.g., specific applications from companies like Salesforce and SAP), thus minimizing the need to develop their own in-house cloud expertise. Since “Buy before build; only build software related to your core competence” is an important principle in any digital transformation, we expected to see a greater investment in software-as-a-service products. Perhaps this number really means that almost any company will need to build software around its core value proposition.

Our respondents approach cloud migration aggressively. Almost half (48%) said they plan to migrate 50% or more of their applications to the cloud in the coming year; the largest group (20%) said they plan to migrate 100% of their applications. (We wonder if, for many of these respondents, a migration was already in progress.) 16% said they plan to migrate 25% of their applications. 36% answered “not applicable,” which may mean that they aren’t using the cloud (though this would indicate much lower cloud usage than other questions do) or that the respondent’s organization has already moved its applications to the cloud. It’s probably a combination of both.

When asked specifically about cloud native development (building software to run in a scalable cloud environment, whether that cloud is public, private, or hybrid), there was an even split between those who have no plan to go cloud native, respondents representing businesses that are already 100% cloud native, and respondents who thought they would be cloud native at some point in the future. Each group was (very) roughly a third of the total. Looking in more detail at respondents who are in the process of going cloud native, only 6% expect to be cloud native within a year. The largest group (20%) said they’d be cloud native within three or more years, indicating a general direction, if not a specific goal.

Does the 67% who are planning to be or are already cloud native conflict with the 47% who said that they’re pursuing a cloud first strategy? It’s jarring—“cloud native” is, if anything, a stronger statement than “cloud first.” Presumably anyone who works for an organization that’s already cloud native is also pursuing a cloud first strategy. Some of the gap disappears if we include respondents executing a multicloud strategy in the “cloud first” group, which brings the “cloud first” total to 57%. After all, “cloud native” as defined by Wikipedia explicitly includes hybrid clouds.

Perhaps more to the point: there’s a lot of latitude in how respondents might interpret slogans and buzzwords like “cloud native” and “cloud first.” Someone who says that their organization will be “cloud native” at some point in the future (whether it takes one year, two years, or three or more years) isn’t saying that there aren’t significant noncloud projects in progress, and three or more years hardly sets an ambitious goal. But regardless of how respondents may have understood these terms, it’s clear that a substantial majority are moving in a direction that places all of their workloads in the cloud.

Cost and other issues

Survey respondents consistently reported that cost is a concern. When asked about the most important initiatives in their organizations pertaining to public cloud adoption, 30% of all respondents said “managing cost.” Other important cloud projects include performance optimization (13%), modernizing applications (19%), automating compliance and governance (10%), and cloud migration itself (11%). Only 6% listed migrating to a multicloud strategy as an issue—surprising given the large number who said they’re pursuing hybrid cloud or multicloud strategies.

These results were similar across all industries. In almost every sector, managing cost was perceived as the most important cloud initiative. Government and finance & banking were outliers; in these sectors, modernizing applications was a greater concern than cost management. (23% of the respondents in the government sector listed modernization as the most important initiative, as did 21% of the respondents from finance & banking.)

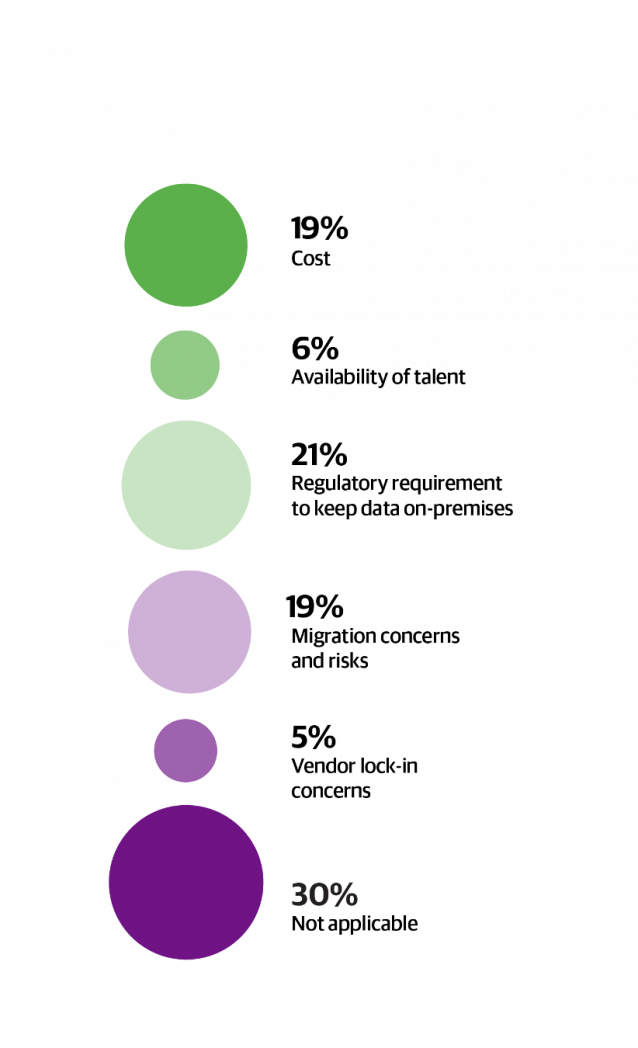

Among respondents who aren’t using cloud computing, 21% said that regulatory requirements require them to keep data on-premises; 19% said that cost is the most important factor; and 19% were concerned with the risk of migration. Relatively few were concerned about the availability of talent (6%, in sharp contrast to our 2021 Data/AI Salary Survey results), and 5% said vendor lock-in is a concern. Again, this aligns well with our results from 2020: keeping data on-premises was the most common reason for

not using cloud computing, and cost was the second, followed by migration risk.

Why is cost such a critical factor? It’s easy to get into cloud computing on a small scale: building some experimental apps in the cloud because you can rent time using a company credit card rather than going through IT for more resources. If successful, those applications become real software investments that you need to support. They start to require more resources, and as the scale grows, you find that your cloud provider is getting the “economies of scale,” not you. Cloud providers certainly know how to set pricing so that it’s easy to move in but difficult to move out.

So, yes, cost needs to be managed. And one way to manage cloud cost is to stay away. You’re not locked into a vendor if you don’t have a vendor. But that’s a simplistic answer. Good cost management needs to account for the true benefits of moving to the cloud, which usually don’t involve cost. By analogy, assembly lines didn’t minimize the cost of building a factory; they made factories more effective. The cloud’s ability to scale quickly to handle sudden changes in workload is worth a lot. Do your applications suddenly become sluggish if there’s a sudden spike in load, and does that cause you to lose sales? In 2021, “Please be patient; our systems are experiencing heavy load” tells customers to go elsewhere. Improved uptime is also worth a lot; cloud providers have multiple data centers and backup power that most businesses can’t afford. (At O’Reilly, we learned this firsthand during the California fires of 2019, which disabled our on-premises infrastructure. We’re now 100% in the cloud, and we’re sure other companies learned the same lesson.)

Regulatory requirements are a big concern for respondents who aren’t using cloud computing (21%). When we look at respondents as a whole, though, we see something different. In most industries, roughly 10% of the respondents listed regulatory compliance as the most important initiative. The most notable outliers were finance & banking (15%), government (19%), and healthcare (19%)—but compliance still wasn’t the biggest concern for these industries. Respondents from the higher education sector reported little concern about compliance (4.8%). Other industries that were relatively unconcerned about compliance included electronics & hardware and media & entertainment (both 3.8%). Although we’re surprised by the responses from higher education, on the whole, these observations make sense: compliance is a big issue for industries that are heavily regulated and less of an issue for industries that aren’t. However, it’s also important to observe that concern about compliance isn’t preventing heavily regulated industries from moving to the cloud. Again, regulatory compliance is a concern—but that concern is trumped by the need to provide new kinds of applications.

Skills

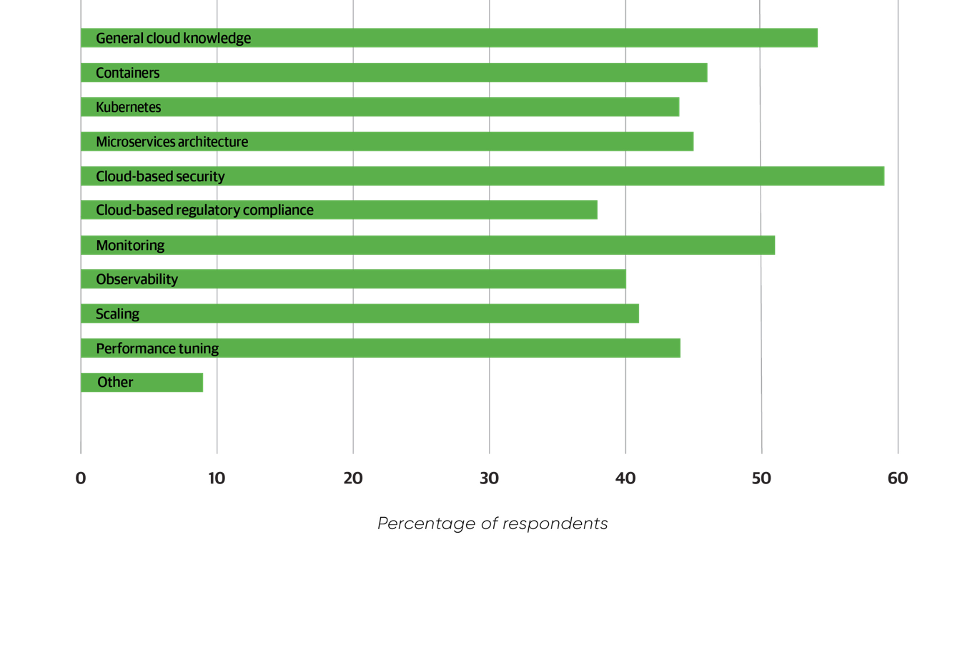

Although only 6% of the respondents who aren’t using cloud computing said that skill availability was an issue, we’re skeptical about that—if you’re not moving to the cloud, you don’t need cloud skills. We got a different answer when we asked all respondents what skills were needed to develop their cloud infrastructure. (For this question, respondents were allowed to choose multiple options.) The most common response was “cloud-based security” (59%; over half of the respondents), with “general cloud knowledge” second (54%). That’s a good sign. Organizations are finally waking up to the fact that security is essential, not something that’s added on if there’s time.

Perhaps the biggest thing to learn from this question, though, is that over 35% of the respondents selected all of the skills (except other”). Most of them were around 45%. Containers (46%), Kubernetes (44%), microservices (45%), compliance (38%), monitoring (51%), observability (40%), scaling (41%), and performance (44%) are all in this territory. Our respondents appear to be saying that they need everything. All the skills. There’s definitely a shortage in cloud expertise. In our recently published 2021 Data/AI Salary Survey report, we noted that cloud certifications were most associated with salary increases. That says a lot: there’s demand, and employers are willing to pay for talent.

Portability between clouds

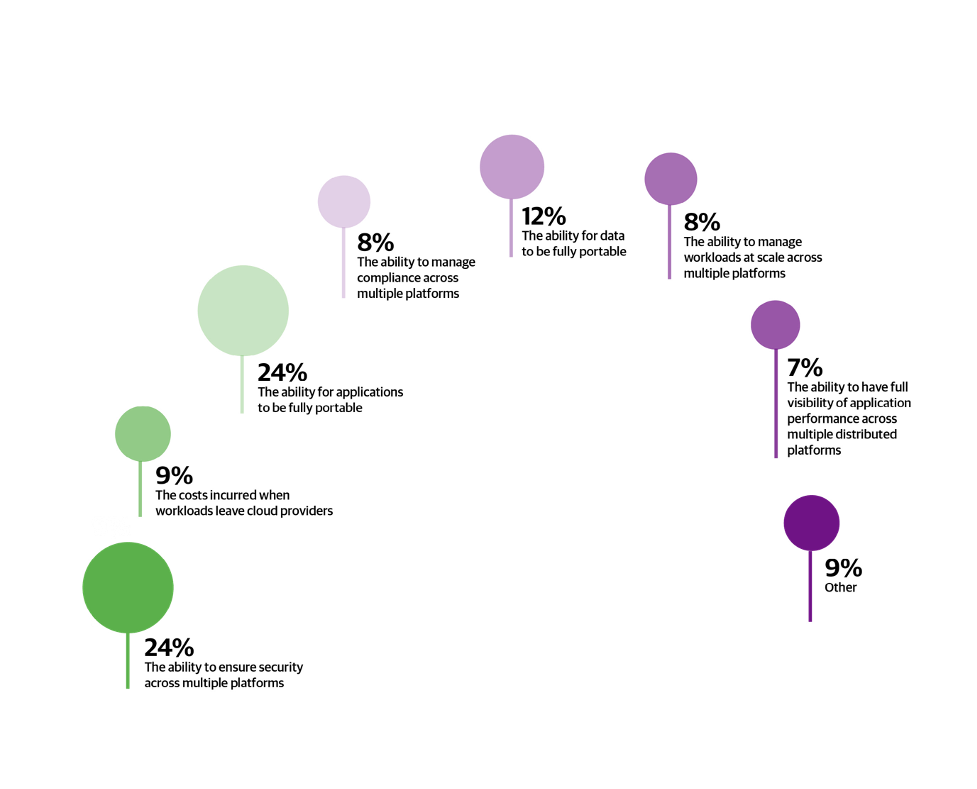

Our final question looked forward to the next generation of cloud computing. We asked about the barriers to moving workloads freely between cloud deployment platforms: what it takes to move applications seamlessly from one cloud to another, to a private cloud, and even to traditional infrastructure. That’s really the goal of a hybrid cloud.

Application portability and security were the biggest concerns (both 24%). The need for portability is obvious. But what may lie behind concern over portability is the string of development platforms that have promised application portability, going back at least to Digital Equipment’s CORBA in 1991 (and possibly much earlier). Containers and container orchestration are themselves “write once, run anywhere” technologies. Web Assembly (Wasm) is the current trendy attempt to find this holy grail; we’ll find out in the coming years whether it suffices.

Security on one platform is hard enough, and writing software that’s secure across multiple execution environments is much more difficult. With the increasing number of high-profile attacks against large businesses, executives have a right to be concerned. At the same time, every security expert we’ve talked to has emphasized that the most important thing any organization can do is to pay attention to the basics: authentication, authorization, software update, backups, and other aspects of security hygiene. In the cloud, the tools and techniques used to implement those basics are different and arguably more complex, but the basics remain the same.

Other concerns all clustered around 10%: the most significant include data portability (12%), important and often overlooked; the cost of moving data out of one cloud provider into another (9%), a concern we saw elsewhere in this study; managing compliance and, more generally, managing workloads at scale across multiple platforms (both 8%); and visibility into application performance (7%).

Until next year

What did we learn? Cloud adoption continues, and it doesn’t appear to have been affected by the pandemic. Roughly 90% of our respondents work for organizations that are moving applications to the cloud. This percentage is only slightly larger than last year (88%) and may not even be significant. (But keep in mind that when you’re at 90%, any further gains come with great difficulty. In practice, 90% is about as close to “everybody” as you can get.)

We also believe that we’re only at the beginning of cloud adoption. Our audience is technically sophisticated, and they’re more likely to be cloud adopters. A large majority of the respondents are in the process of moving applications to the cloud, indicating that “cloud” is a work in progress. It’s clearly a situation in which the more you do, the more you see that can be done. The more workloads you move to the cloud, the more you realize that other workloads can move. More important, the more comfortable you are with the cloud, the more innovative you can be in pushing your digital transformation even further.

Concerns about compliance remain significant. Not surprisingly, those concerns are higher among respondents who aren’t using the cloud than among those who are. That’s natural—but looking at the rapid pace of cloud adoption in heavily regulated industries like finance & banking makes us think that “compliance” is more of an excuse for noncloud users than a real concern. Yes, compliance is an issue, but it’s an issue that many organizations are solving.

Managing costs is obviously an important concern, and unlike compliance, it’s a concern ranked more highly by cloud users than nonusers. That’s both normal and healthy. The common perception that cloud computing is inexpensive isn’t reality. Being able to allocate a few servers or high-powered compute engines with a credit card is certainly an inexpensive way to start a project, but those savings evaporate at enterprise scale. The cloud provider will reap the economies of scale. For a user, the cloud’s real advantages aren’t in cost savings but in flexibility, reliability, and scaling.

Finally, cloud skills are in demand across the board. General skills, specific expertise in areas like security, microservices, containers, and orchestration—all are needed. Whether or not there’s a shortage of cloud expertise in the job market, this is an excellent time to pursue training opportunities. Many organizations are dealing with the question of whether to hire or train their staff for new capabilities. When pursuing a cloud transformation, it makes eminent sense to rely on developers who already understand your business and your applications. Hiring new talent is always important, but giving your current staff new skills may be more productive in the long run. If your business is going to be a cloud business, then your software developers need to become cloud developers.

Footnote

- A brief note about precision. We’ve rounded percentages to the nearest 1%, except in some cases where the percentage is small (under 10%). With nearly 3,000 respondents, 0.1% only represents 3 users, and we’d argue that drawing conclusions based on a difference of a percentage point or two is misusing the data.