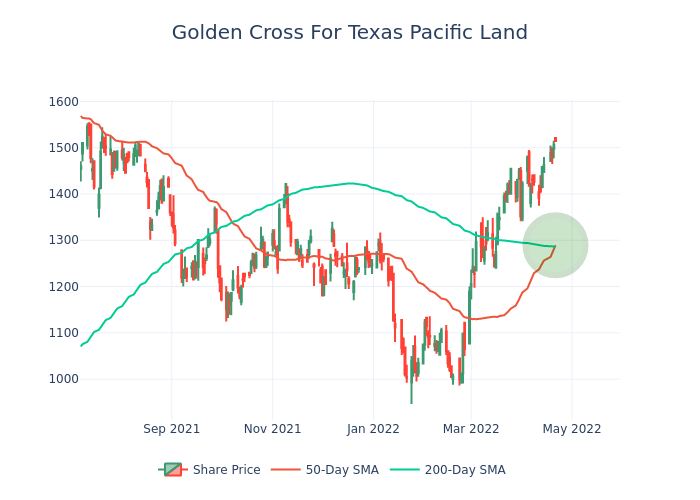

If history is any guide, there may be good fortune ahead for shares of Texas Pacific Land TPL. A so-called “golden cross” has formed on its chart and, not surprisingly, this could be bullish for the stock.

What To Know: Many traders use moving average crossover systems to make their decisions.

When a shorter-term average price crosses above a longer-term average price, it could mean the stock is trending higher. If the short-term average price crosses below the long-term average price, it means the trend is lower.

Why It’s Important: The 50-day and the 200-day simple moving averages are commonly used.

The golden cross occurs when the 50-day crosses above the 200-day. This could mean the long-term trend is changing.

That just happened with Texas Pacific Land, which is trading around $1514.34 at publication time.

Remember: Seasoned investors don’t blindly trade Golden Crosses.

Instead, they use it as a signal to start looking for long positions based on other factors, like price levels and company fundamentals & events.

For seasoned investors, this is just a sign that it might be time to start considering possible long positions.

With that in mind, take a look at Texas Pacific Land’s past and upcoming earnings expectations:

| Quarter | Q4 2021 | Q3 2021 | Q2 2021 | Q1 2021 |

|---|---|---|---|---|

| EPS Estimate | 11.14 | 9.13 | 7.33 | 5.77 |

| EPS Actual | 10.21 | 10.82 | 7.36 | 6.45 |

| Revenue Estimate | 129.23M | 109.92M | 93.22M | 75.22M |

| Revenue Actual | 147.18M | 123.69M | 95.93M | 84.16M |

Do you use the Golden Cross signal in your trading or investing? Share this article with a friend if you found it helpful!

This article was generated by Benzinga’s automated content engine and reviewed by an editor.