Bitcoin traded under the psychologically important $40,000 level at press time on Thursday evening, with the global cryptocurrency market cap falling 4.35% to $1.75 trillion.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | -6.1% | -5.6% | $39,300.01 |

| Ethereum (CRYPTO: ETH) | -4.3% | -5.2% | $2,596.16 |

| Dogecoin (CRYPTO: DOGE) | -3.8% | -8.1% | $0.12 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| ICON (ICX) | +41.5% | $0.93 |

| Waves (WAVES) | +30.53% | $28.71 |

| ThorChain (RUNE) | +11.1% | $4.91 |

See Also: How To Buy Bitcoin (BTC)

Why It Matters: On Thursday, the U.S. Labor Department released inflation numbers for February. Headline consumer price index or CPI rose 7.9% in the month, above an estimated 7.8%, the biggest increase since January 1982.

Risk assets moved lower after the inflation data. The S&P 500 and the Nasdaq closed 0.4% and 0.95% lower at 4,259.52 and 13,129.96, respectively.

Cryptocurrencies moved in line with stocks and headed downwards. However, some analysts are of the view that the apex coin may emerge as a hedge against inflation.

“Maybe the short-term price will drop due to panic, but long-term I think #Bitcoin is by far the best bet against inflation,” tweeted Michaël van de Poppe, a cryptocurrency trader.

Investment thesis with such a high inflation; would you want to be in equities, $USD, commodities or #Bitcoin?

Maybe short-term price will drop due to panic, but long-term I think #Bitcoin is by far the best bet against inflation.

— Michaël van de Poppe (@CryptoMichNL) March 10, 2022

The co-founders of on-chain analysis company Glassnode, Jan & Yann, tweeted that commodities look strong and there is a “rotation to value.”

A chart shared by them, depicting the top 10 assets by market cap, reveals a 15% decline in the year-to-date performance of Bitcoin, while gold shot up 14%.

The top 10 assets by market cap reveal strong commodities and rotation to value

Will liquidity flow to riskier assets like #Bitcoin given a 96% prob of target rates 25-50 bps? Find out here https://t.co/6eOWyypDgk pic.twitter.com/OPTdhQwUbi

— Negentropic (@Negentropic_) March 10, 2022

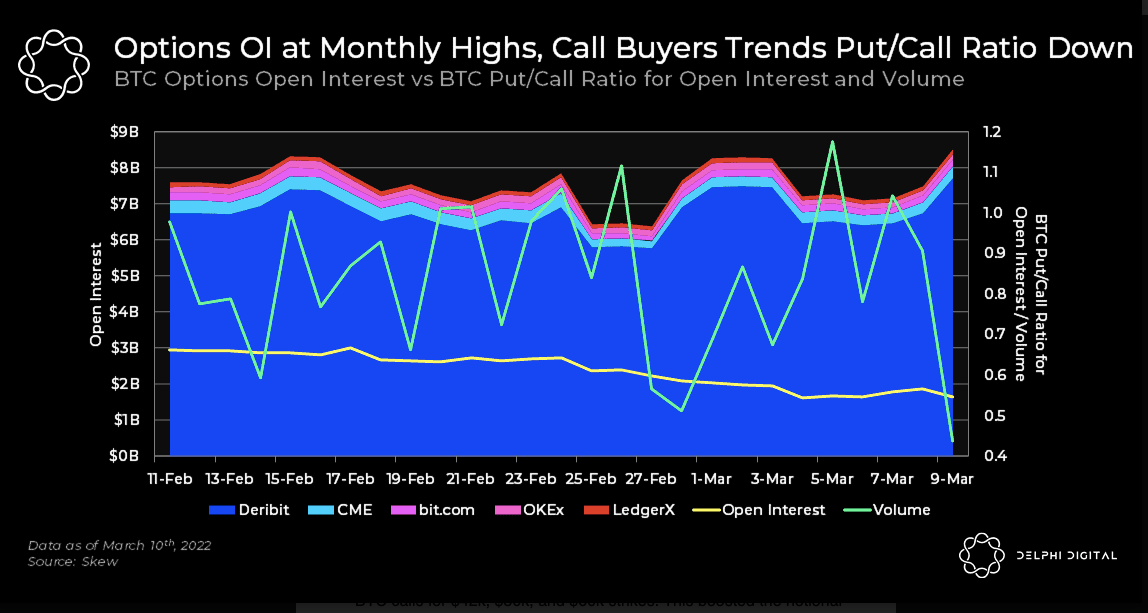

Meanwhile, the put/call ratio for Bitcoin hit a six-month high of 0.69 in February amid bearish market sentiments, according to Delphi Digital.

On Thursday, the volume-adjusted put/call ratio hit a monthly low of 0.44 as call volumes rose. Deribit traders were buying April 29 BTC calls for $42,000, $50,000 and $60,000 strikes, Delphi said, boosting the notional value up to $193 million on the exchange.

“This might indicate that traders are turning bullish, even in an uncertain macro environment.”

BTC Options Open Interest Vs BTC Put/Call Ratio For Open Interest and Volume — Courtesy Glassnode

Ethereum has formed a stronger correlation with the S&P500 index than Bitcoin over the past month. Gold has a “spot-on” inverse correlation with the two largest cryptocurrencies by market cap, according to financial market data and content platform Santiment.

#Ethereum is staying surprisingly close to the price of the #SP500. In fact, its correlation has been much more tight than #Bitcoin‘s own correlation with the #SP500 over the past month. Also, #gold has had a spot-on inverse correlation to both. https://t.co/3TJH7zwjcd pic.twitter.com/BPatTroxGW

— Santiment (@santimentfeed) March 10, 2022

Read Next: Investing Stimulus Checks In This Cryptocurrency Would Have Fetched Whopping 23674% Returns Now