10th July 2022

UK debt-to-GDP could reach 430% by 2072

The Office for Budget Responsibility (OBR), a public body funded by the Treasury, this week published its long-term outlook for the UK economy. This shows that a riskier world, combined with an aging population, will leave the public finances on an unsustainable path.

It is hard to escape the conclusion that the world is becoming a riskier place. The past two decades have seen a global financial crisis, a global health crisis, and now a global energy crisis triggered by Russia’s invasion of Ukraine, which has also prompted increases in military spending. These global shocks, alongside other domestic pressures – such as the increasing social and health costs of aging – are placing public debt on an unsustainable path.

In economics, debt-to-GDP is the ratio between government debt and gross domestic product (GDP). For example, a debt-to-GDP ratio of 50% means that a country has accumulated government debt equivalent to half of the country’s economic output. A debt-to-GDP ratio of 60% is quite often noted as a prudent limit for developed countries. Indeed, the EU specifies this upper limit for one of its convergence criteria, which countries hoping to join the eurozone must stay below.

At the start of the 21st century, the UK’s debt-to-GDP ratio stood at a healthy 27%. The Treasury’s long-term outlook showed this figure staying below 40% until at least the year 2025. The future seemed bright, as the country welcomed in the new millennium, enjoying consistent growth, a North Sea oil and gas boom, and revitalised public services under the Blair administration.

During the global financial crisis of 2007–8, the UK’s debt-to-GDP more than doubled, only reaching a plateau in the mid-2010s. The COVID-19 pandemic has seen it rise again – from 80% to nearly 100% for the first time since 1963. Hopes of a recovery have been diminished by the highest inflation in 40 years and the soaring cost of energy, in part due to the conflict in Ukraine.

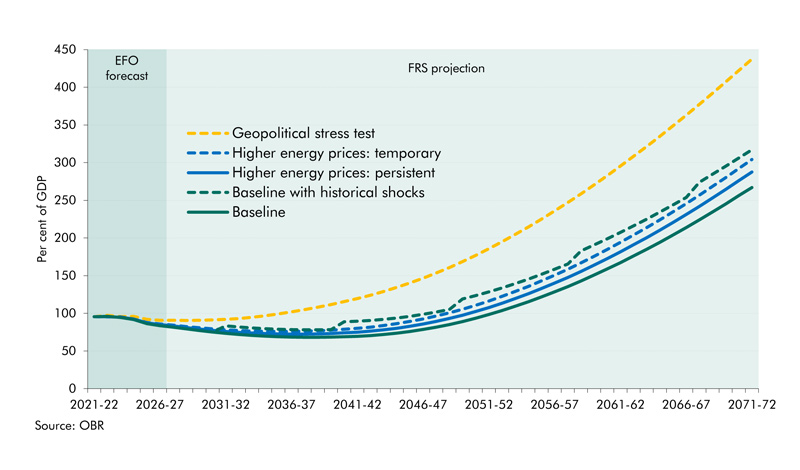

With mounting concerns over economic stagnation, the Office for Budget Responsibility (OBR) this week published its latest analysis. The report includes a number of scenarios, projected as far out as the year 2072.

“We start from where the public finances stand today and then assess the impact of demographic, economic, technological, and other trends on future government revenue, spending, and financial transactions,” the authors write. “We then project forward their implications for the potential path of public sector net borrowing and debt over the coming half-century.”

The long-term outlook for the UK appears grim. In all the above projections, the OBR foresees an inexorable rise in government debt from the 2040s onward (asymmetries in the welfare system explain the temporary shock being fiscally more costly than the persistent one). Even in the best-case scenario, the UK’s debt-to-GDP ratio hits 267% by 2072.

“Our baseline projection for debt assumes that nothing else goes wrong over the next 50 years,” explained Richard Hughes, OBR Chair during a press conference. “But if the past two decades has taught us anything, it’s that things can and will go wrong – and that when they do, they can have significant and lasting effects on the public finances.”

The worst-case scenario assumes that geopolitical tensions continue rising, with threats to both security (such as a major cyber-attack) and economic integration (such as trade wars) – and foresees a debt-to-GDP of more than 430% by 2072, even worse than Venezuela today.

Aside from Brexit, which has been a factor in recent years, the UK’s situation is by no means unique. Countries around the world are facing similar challenges in the longer term, especially in regard to aging and demographic shifts, as well as the impacts of climate change. The OBR’s analysis provides an intriguing glimpse into what may lie ahead economically, over a timescale that appears distant, yet within the lifetime of many people alive today.

The seemingly permanent, twin trends of rising expenditures and falling revenues, accompanied by growing social unrest, may put governments under pressure to experiment with new and radical ideas. The concept of a universal basic income, for example, is already being considered by some countries.

New technologies could also offset the economic stagnation of the mid-21st century. Solar PV and other clean tech will become cheaper and more efficient as we transition away from fossil fuels and into a post-carbon age. The decentralised nature of renewables and the abundance they offer may result in less conflict over finite energy resources and less price volatility. Meanwhile, life extension treatments, if successfully translated from mice into humans, could ease the burden of public health costs. AI and robots could fill many roles that humans are unwilling or unable to perform, keeping the wheels of society turning in numerous ways. All of this could eventually pave the way to a post-scarcity world – but only after decades of social and economic turmoil.

—

• Follow us on Twitter

• Follow us on Facebook

• Subscribe to us on YouTube

Comments »