Sponsored Content by Medjet

If you’ve traveled for any time at all, then you have one of those stories… a close call, the story of the time that was nearly a travel disaster – or maybe you had an actual travel disaster.

I have plenty of those stories – so many that I created a special ‘tag’ for them on my blog called “Bad Travel Stories”. They have ranged from being stranded in a country indefinitely, unwanted advances from men, getting sick in a remote place, nearly getting arrested in Kazakhstan, altitude sickness in remote areas, and the list goes on. If you are the type of person who likes to read about travel disasters…then have fun with these stories.

However, I want to be clear – my goal is not to scare you about travel – I never want to do that. I WANT people to travel to far-off places! My travel disasters didn’t occur just because I was traveling – many of these things could’ve happened at home too or on domestic trips. Bad things happen everywhere. Travel is not any more dangerous than your regular life.

My goal is to give you a few tips on how you can avoid travel disasters; basically, decreasing the odds that anything horrible will happen while venturing away from your home.

What is a Travel Disaster?

I don’t have a formal definition for this as it’s probably different for everyone. It can range from losing luggage to having to be evacuated from a boat or remote spot due to medical or safety issues.

3 Ways You Can Minimize Travel Disasters

1. Travel Insurance

Of course, travel insurance is the first step; I’ve written a lot about the importance of travel insurance, annual plans, and COVID coverage. It’s great for minor travel disasters; things like lost luggage, delays, and cancellations for you and your travel companions. In addition, it covers medical emergencies and also normally offers some sort of evacuation assistance.

Of course, you will need to read the fine print of any travel insurance to understand exactly what it covers. Buying travel insurance shouldn’t be done lightly – you need to research it and ensure you understand the coverage for your particular type of travel.

I think the pandemic made us all take a closer look at travel insurance. I use annual travel insurance from Allianz and I love it as I don’t have to remember to buy it for every trip I take! But – it doesn’t cover everything.

2. Satellite SOS Services

There are a number of satellite tracking and SOS services available to purchase for travelers and adventurers. I use the Garmin inReach mini for peace of mind when I’m hiking, traveling to remote places, or just traveling to countries that are a bit more volatile. It’s small and can be hooked to my backpack. At its base use, it allows me to send texts via satellite to let people know where I am and am ok; or I can text to send help.

The subscription also provides global, interactive SOS capabilities; you are able to trigger a distress signal, receive a delivery confirmation that help is on the way, and maintain a 2-way text conversation with the International Emergency Response Coordination Center. The center will assist with your emergency, track your location, and notify the most appropriate emergency response for your unique situation. SOS coverage is automatically included with the subscription on the inReach product. However, this basic coverage does not provide any insurance or cover any costs incurred from an SOS activation.

3. Medical Evacuation Insurance

When it comes to medical evacuation insurance, travel insurance only goes so far – literally. Most travel insurance gets you to the nearest hospital capable of treating you. The insurance company makes the choice on where you go.

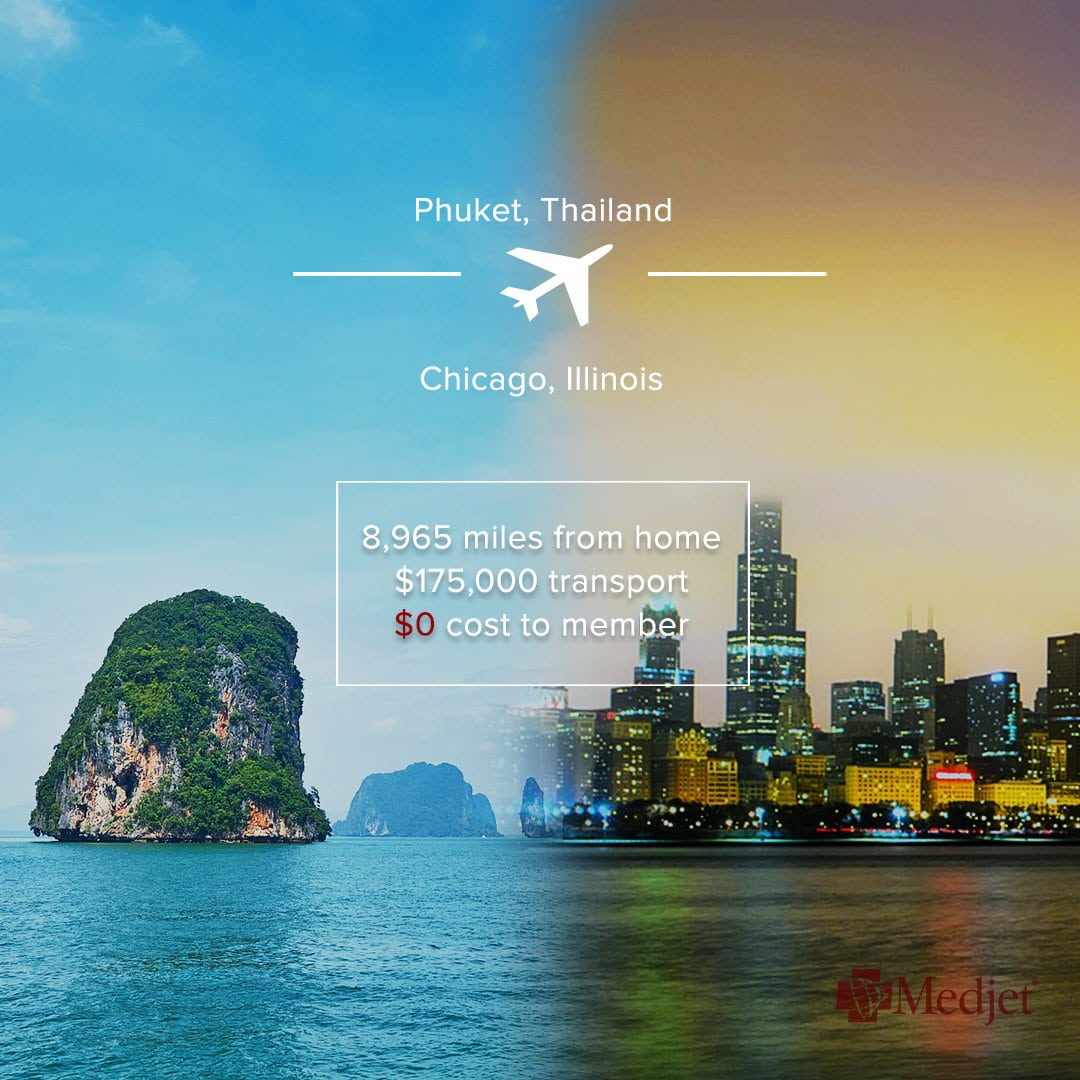

Subscription medical transport services like Medjet provides air medical transport to move you from the hospital you are at (in a foreign country) to a hospital of your choice AT HOME.

When it comes to medical evacuations, most travel insurance will cover them, but ONLY to the nearest hospital capable of treating you. And there are definitely limitations. Read the fine print! The insurance company makes the choice on where you go.

Subscription air medical transport programs like Medjet arrange and pay to get you moved to a hospital of of your choice AT HOME.

What is Medjet and Why You Need It

Medjet gives you choices that travel insurance doesn’t. A Medjet membership gets you from a hospital you don’t want to be stuck in to a hospital at home. You might be thinking – my travel insurance already provides “repatriation” – but read the fine print! The vast majority of traditional health providers require you stay in the hospital you’re in until you’re well enough to fly home commercially. That’s why you read about people “stuck” in foreign hospitals even though they have insurance, or paying for an air ambulance ride home out of their own pockets. That can be $25,000 – $180,000 depending on where you are.

So technically you really need both travel insurance + Medjet because the medevac coverage on most travel insurance only gets you to the “nearest acceptable” hospital – not home.

My Near Travel Disaster in India

You might be questioning if extra medical transport protection is really necessary. Let me tell you a story…

A few years ago, I unknowingly contracted blood clots on a long-haul flight to India. While in India (once again unknowingly) the blood clots broke free and lodged themselves into my left lung; technically termed a pulmonary embolism. Even though I was in pain and was having trouble breathing – I had just shrugged it off as ‘it’s India – the pollution is horrible’.

I traveled in India for 2 weeks like this and then took another long-haul flight back home, all while feeling sick and having trouble breathing and sleeping.

Let’s be clear – I probably should have died at that point. When left untreated, the mortality rate of a pulmonary embolism is up to 30%.

I went to Urgent Care when I returned home because I was in so much pain and that’s when I was diagnosed.

I was lucky…really lucky. I often think of all of the things that could’ve happened. I could have died instantly when the blood clots moved into my lungs. I could have passed out or had a stroke and ended up in a hospital somewhere in India. We were traveling in small villages – so I have no idea where I would’ve ended up. I could have gone to have the pain in my chest looked at by a doctor in India and ended up admitted to a local hospital. In all of these scenarios, the one thing I kept thinking about was that I didn’t really want to be in a hospital in India indefinitely.

Sorry India – I love you, but when I’m sick I want to be home in the US.

If I had ended up in an Indian hospital, with Medjet I could’ve been transported home to the US, which would have made me and most importantly, my family feel better.

Medjet Costs are Surprisingly Affordable

You might think that this service is a total luxury and the costs are expensive – but surprisingly it’s not unreasonable. Medjet is a membership program. Unlike insurance, there are no claim forms, subrogation, or bills that show up months after your incident. You pay your membership fee, and that’s it.

You can get a Medjet annual membership if you travel a lot, or purchase it trip by trip. They have time periods as short as 8 days. *

*Residents of the U.S., Canada or Mexico can join. You must enroll prior to travel.

Age Restrictions

As with many things medical – there are a few age restrictions. They offer their standard membership for 74 years old and younger. However, they do offer special coverage (that needs to go through an approval process) for travelers 75+ years old.

I traveled a lot with my dad in his 70’s and 80’s to remote places like Antarctica and we hiked in remote Nepal. Medjet memberships are perfect for this type of multigenerational travel. I absolutely would recommend this for people traveling with parents.

Peace of Mind When Traveling to Remote Destinations

One of my travel specialties is adventure travel in remote places – or what I often call Extreme Travel. I often think about the extra precautions that one must take when traveling to remote places like Wrangel Island, Greenland, Kazakhstan, Mongolia, and even places like Nome Alaska where there are no roads that connect you to the rest of Alaska. This is why I got the inReach device and have travel insurance. However, taking one additional step of getting a Medjet membership would complete this and make sure I can get home if something does go wrong.

One of my good friends and fellow travel writer recently purchased an annual Medjet membership because she was planning multiple trips to remote destinations in Peru, Ecuador, and Africa. I asked her why she got the Medjet membership.

“When I travel to really remote places, having the repatriation on top of regular travel insurance was important to me. If I got into medical trouble in a remote destination there’s a good chance that the care offered there may be less than I preferred. Knowing that Medjet will repatriate me to a facility of my choice gives me peace of mind and my family peace of mind.”

I can definitely say that as I move forward with my travels, Medjet is going on my ‘packing list’. I’ve been pretty lucky so far, but considering I’m over 50 and still love to do crazy things in remote places – Medjet is the ‘peace of mind’ solution.

Related

Disclosure:

This post is brought to you by Medjet. However all opinions and stories are uniquely mine.