Opinions expressed by Entrepreneur contributors are their own.

As I was talking to one of my early-stage founders about corporate governance principles, I realized that what I was sharing with him isn’t common knowledge. Early-stage founders always here “seek smart capital,” but I realized that founders don’t really understand the full depth of that statement or why it is so important to be strategic when raising capital, especially in the early rounds (pre-seed, seed and Series A).

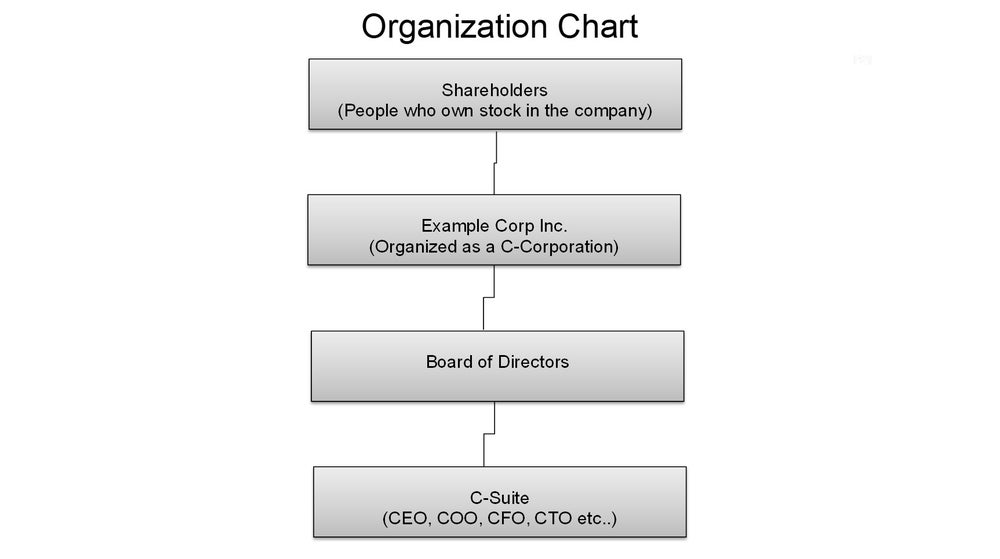

Let’s start by changing the phrase “seek smart capital” to “seek synergistic capital.” To crystallize the point of why seeking synergistic capital is so important for early-stage founders, I want to cover some key points of corporate structure and governance, as understanding this from that lens will better help you see the importance of the topic. Observe the organizational chart I’ve created below:

Image Credit: Fredrick D. Scott, FMVA

It’s not the prettiest org chart I’ve ever done, but it will illustrate this point well. The most important takeaway from the chart above is understanding how the hierarchy works. Starting from the bottom of the chart and working our way up:

C-suite executives

C-suite executives are considered “day to day” managers of the business. They are responsible for overseeing and making sure the company and staff are operating within the mission and vision, as outlined by the board of directors (with input from the C-Suite). They make sure the company is operating, in all aspects, as efficiently as possible and hitting the various growth metrics set to ensure the company is generating more revenue year after year. Most importantly, you must understand that a company’s C-suite works to the will and pleasure of the board of directors. This is a key point of understanding, and you will see why in a bit.

Related: The Basics of Raising Capital for a Startup

Board of directors

The next level up in the hierarchy is the board of directors. Their job is to provide oversight of the C-suite, to implement macro policy, governance documents and tempo. Most importantly, their job is to protect shareholder interests by insuring two things:

One, that the C-suite is operating in an efficient manner and steering the company in the direction that, in the board’s opinion, will lead to the best possible chance of increasing growth, revenue and profit margins year after year.

And two, that there are proper guardrails in place that govern the way the C-suite operates and provide sufficient risk mitigants against “irregularities” and/or irrational strategies that, in the board’s opinion, would erode shareholder value. More importantly, the board, generally, has the ability to effectuate swift action against a C-suite executive in the event that they feel such action would be in the best interests of the company, and by extension, the shareholders.

A good example of this played out pretty publicly at WeWork when the now-former CEO, Adam Neumann, was ousted from the very company he founded by the company’s board of directors, because (in short) they felt that his actions were no longer serving the best interest of the company, and by extension, the shareholders.

Shareholders

Let’s take a deeper look at them. Shareholders (also known as stockholders) are the owners of a company. They buy stock in the company, and each stock they buy represents a percentage of ownership in the company. How big or small that percentage of ownership depends on how much stock the company issues and how many of those stocks a person or another company (both of which are considered investors) buys. Let’s look at two very, very simple examples of this:

Company A has issued 100 shares of stock. An investor decides they want to buy 10 shares of Company A’s stock. That investor now owns 10% of Company A.

Company B has issued 1,000 shares of stock. An investor decides they want to buy 10 shares of Company B’s stock. That investor now owns 1% of Company B.

Note that these are, again, very simple examples, and things can get quite a bit more complex than that when looking at a company’s equity structure. However, the purpose of these examples is to illustrate the point that shareholders are part-owners of the company.

Related: Should You Pitch Your Startup to Early-Stage Investors?

The importance of seeking synergistic capital

With the above points established, let’s examine why seeking synergistic capital as an early-stage company is crucially important. As outlined in the above discussion, it would seem like everyone is working towards the same end: To make more money for the company, and in turn, make more money for the shareholders of the company. In the ideal situation, everyone is aligned completely in that endeavor. However, things are rarely ideal in the real world, especially for early-stage companies. While the ultimate goal may be the same (to make more money), there can be a divergence of opinions amongst senior executives and the board of directors on the best way to go about achieving the ultimate goal. This divergence is where trouble can begin and where failure can ensue for early-stage companies and/or their founders.

The trouble lies in how the majority of early-stage companies go about raising capital. Generally, because of the very nature of being a startup business and all the obstacles that come along with that, founders who are trying to raise capital for their businesses (especially in the early rounds), are so desperate for capital that they are willing to take it from anyone who’s willing to give it.

The challenge with taking this approach is that, a lot of times, your earliest investors (especially those with experience in early-stage investing) will likely require that they are given a board seat as a condition to giving you capital. The rationale from an investor’s standpoint is that they want to be able to exercise oversight on the company — and by extension — the use of the capital they give the company, to ensure that the capital is being used properly and efficiently.

When a founder understands this fact, what seems like such a minor thing (giving away a board seat) isn’t so minor anymore. Remember, the board’s job is to protect shareholders’ interests and do what they feel is going to drive shareholder value the fastest. Their belief on how that can be done may not align with a founder’s vision for the company.

Now, a lot of founders reading this article will say “Well I own most of my company’s shares so this is a non-issue for me.” That may be true TODAY, however, as you raise more and more capital, you have to give away more and more ownership of the company (known as dilution), so in short: The more you raise, the less you own. Without proper planning, it is easy to find yourself, as a founder, in the minority ownership position of the very company you started.

Couple that with a board of directors that doesn’t fully see eye to eye with the way you are running the company, and you could easily find yourself on the outside looking in (meaning fired). Even if you are the chairman of the board, it doesn’t matter, you can still be outvoted by the rest of your board.

Fun fact: Did you know that, according to Roberts Rules of Order (the gold standard for how to conduct board meetings), the chairman of the board doesn’t even get to vote unless it is to break a tie?!

This is why seeking synergistic capital is so important for early-stage founders. You want to ensure that the people who are investing in you and your company are fully aligned with you and your vision. You want those who believe in you to help you add accretive value to your company by way of experience, relationships,and time investment into your development as a founder and CEO (and into the development of the company itself). In my opinion, anything short of this is a recipe for eventual disaster (remember 94% of venture capital-backed companies eventually fail).

The best chance a founder and their company have to succeed is by being strategic and intentional in every aspect of their business endeavors, and that is especially important in the aspect of raising capital. Founders have to remember that venture capital doesn’t work without companies to invest in, so it is important to remember this point, and raise capital as a founder, not as a pauper!

Related: Raising (Smart) Capital And Why It’s Not Just About The Money